FX markets extend into sideways following an eventful week. Previously we saw the Fed refraining from asset purchases reduction and as consequence US dollar was lost broadly against its major peers on Wednesday US evening session and continued its slide on Thursday as well. Although contrary to other major currencies the Japanese Yen has been under selling pressure yesterday due to risk-on. In addition, a member of BOJ board said that monetary stimulus might expand further since inflation target of 2.0% is still far away.

The

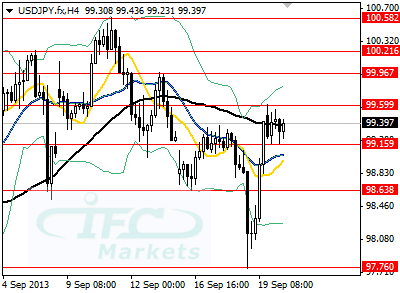

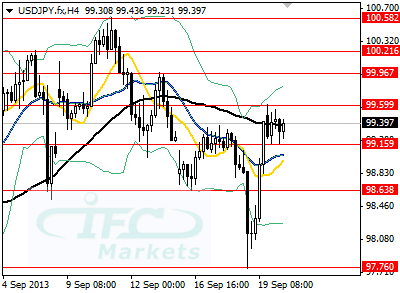

USDJPY therefore after drawing a

support line at 97.76 started recovering back previous lost ground and rose even higher than before Fed’s announcement achieving resistance at 99.59.

On Thursday evening a series of positive US data was announced and perhaps that was another reason for USDJPY’s upside unexpected performance. US Jobless Claims stood at 309K the previous week up compared to two weeks ago but well below expectations of 331K claims.

Moreover, Existing Home Sales for August was stronger and Philly Fed Manufacturing Index for September was doubled compared to estimations suggesting that demand in US spending, investments and demand is strengthening more than estimated. Thus, in our opinion USDJPY would continue higher and the US dollar index bottomed at 80.03 likely providing a nice buy opportunity for the longer term, with data improvement of course. Fed has reiterated that is data dependent, thus we get closer to asset tapering with every positive surprise.

Now let’s check other major pairs like the

EURUSD which is consolidating in 1.3565/1.3506 tight zone after advancing by 1.58% from 1.3353 to top of the last 7-months at 1.3565. On Monday EZ PMI Manufacturing indicators would be released and we are alerted for that. We saw the

GBPUSD rising to 8-month cap at 1.6161 but was weighed by sluggish Retail Sales in August retreating to 1.6024. A technical correction is always welcome as it gives the chance for further positioning in the market and indicates a healthy up trend.