- Analytics

- Market Overview

Investors look for the further economy recovery - 26.12.2013

In this morning the USDJPY pair has refreshed its 5 year maximum against Bank of Japan representative’s statement (BOJ Minutes). Market participants admit that the Japanese bonds volume may increase in March-April 2014. A second factor that influence USDJPY course is a publication of macroeconomic indicators in Japan. November housing starts turned out to be higher then the preliminary forecast. It may confirm a correctness of BOJ economic policy aimed at the yen weakening. Today, at 23-30 GMT (0+) one more block of Japanese statistics is to be released. It includes November consumer price index (CPI). We expect that CPI increase will correspond to 1,1% this year. Still it is far from 2% and corresponds to BOJ bonds purchase ending. A Japan Prime Minister Shinzō Abe has visited Yasukuni temple. This is a first visit of this place by the government head since 2006. In Asia this temple is associated with a Japanese militarism in Second World War. The visit of Shinzō Abe caused a discontent in China and South Korea – Japanese yen has been weakened.

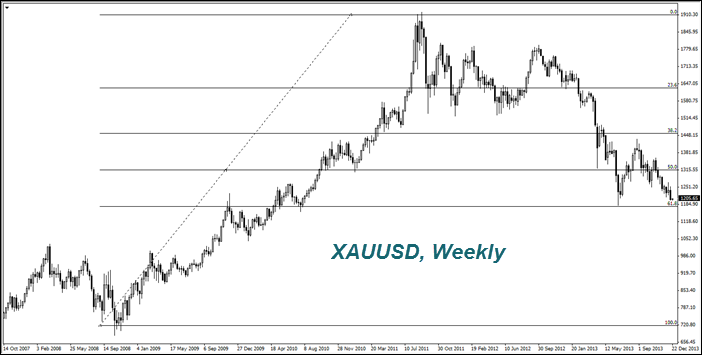

The price of gold (XAUUSD) fell by 28.2% since the beginning of 2013. This is the most significant drop of its value over the last 32 years. We may remark following influence factors: the recovery of the global economy, rising stock market indices and low inflation in the USA. All this has reduced the appeal of investments in gold for major hedge funds. Note that the growth of the S&P 500 since the beginning of 2013 amounted to 30.2 %, which almost coincides with falling in gold prices. Many participants of the market believe that the "yellow metal" will start rising in price in the case of a descending correction at stock markets - they expect to see quotes around $ 1000. In our own opinion, the current level of gold prices may be attractive to consumers from China and India.

See Also