- Analytics

- Market Overview

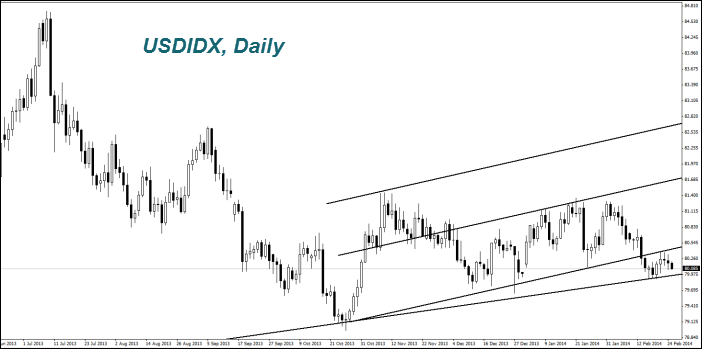

The neutral trend continued in the the Forex market on Monday - 25.2.2014

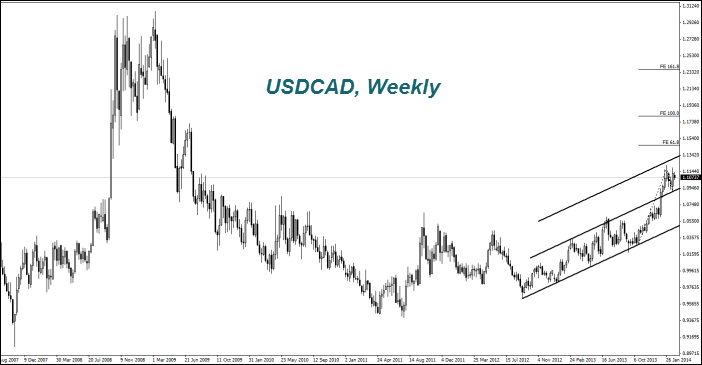

Yesterday, investors ignored a slight increase in consumer prices in January in the EU to 0.8%. The inflation is far below the target level of 2%. The ECB Governing Council member Ignazio Visco said that his agency may set a negative deposit rate in case of necessity of preventing the deflation. In January, consumer prices rose only in three Eurozone countries : Estonia, Latvia and Slovakia. Deflation is observed in Greece and Cyprus. In other countries of the Eurozone, the inflation level fell. In our opinion, the possible reduction of rates in the EU could significantly weaken the Euro (fall on the EURUSD chart). The next ECB meeting will take place next week. A significant increase in the euro is unlikely before it happens. The Canadian Dollar (USDCAD) strengthened slightly (down on the chart). Meanwhile, a prominent economist Nouriel Roubini called «Dr. Doom » because he predicted the real estate market collapse in the U.S. in 2008, now expects a significant correction of housing prices in Canada. According to him, the Canadian dollar is overvalued and the Bank of Canada should take stronger measures to weaken it at least to 10%. The Canadian Finance Minister, Jim Flaherty, answering journalists' questions about Roubini’s opinion said that only the market can determine the Exchange Rate.

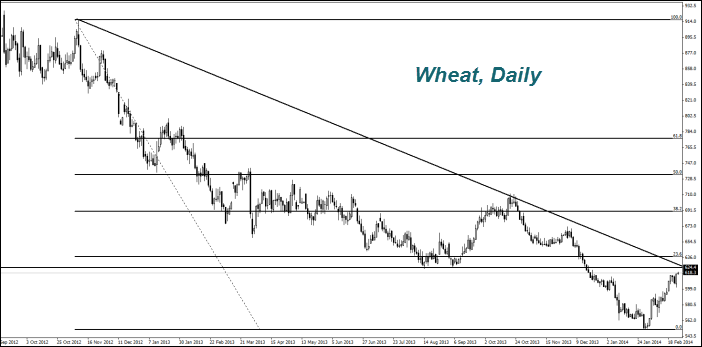

Aggravation of the political situation in Ukraine contributes to higher prices for wheat (Wheat). The country is ranked the second in the world grain exports after the United States. Another factor increasing the wheat price has been the decline of its crops in Canada by 10% to 23.3 million acres in favor of rape. In the past agricultural season 2013/14 Canadian farmers were not able to fully realize the harvest because of transportation problems. The USDA reported an increase in soybean exports (Soyb) per week by 68% to 1.27 million tons compared to last year. China bought 54% of this volume. As it was expected, quotes of soybean updated five-month high and continue to be in the uptrend. Inventories of copper (Copper) in the LME have been falling down eight consecutive months. They reached their lowest level since mid-December 2012 about 282.5 tons. We do not exclude an upside trend on copper.

News

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also