- Analytics

- Market Overview

The speech of the ECB head will take place today - 3.4.2014

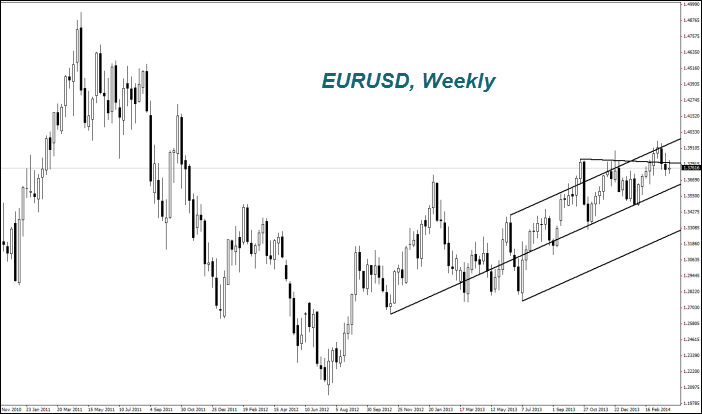

The euro exchange rate (EURUSD) fell slightly on Wednesday. Investors do not exclude negative statements of the ECB head. Today at 13-45 CET the meeting of the European Central Bank will take place which is not expected to change the interest rate. Now it is 0.25 %. A few days ago the IMF advised the ECB to consider reducing the interest rate. According to it, the moderate increase in consumer prices following it will contribute to the revival of the European economy. IMF forecasts a slight increase in European GDP by 1-1.5 % for the next two years. Investors fear that the ECB head Mario Draghi may announce plans for monetary policy easing to avoid deflation in the EU today at 14:00 at a press conference. Recall that the inflation rate was 0.5% in March. Whereas according to the ECB it should exceed 1% and achieve a level of 2% by 2016. Note that before the meeting and press conference of the European Central Bank, the data on retail sales for February will still be released today at 11-00 CET. They are expected to be negative for the single European currency. We think that in general , the current economic situation in Europe is a prerequisite for the weakening of the Euro . On its daily chart it would look as downtrend formation. Note that representatives of the ECB now believe the Euro to be too "expensive" and even call him the victim of devaluative policy of other countries.

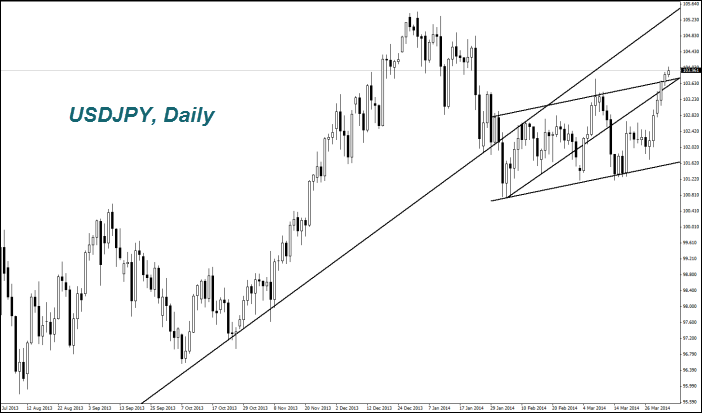

The Japanese Yen exchange rate ( USDJPY ) continued its expected growth on the chart and rose to its highest in ten weeks. From the economic point of view it means weakening of the Yen. It continues for the sixth consecutive day, and we have written a lot about its reasons. Note that at the level of 104 of the Yen a lot of option contracts have been accumulated. This may prevent further growth before the U.S. data release on Friday. This week no more macroeconomic information will be in Japan. Yesterday's indicators were neutral as expected. Another portion of statistics will be released on Monday.

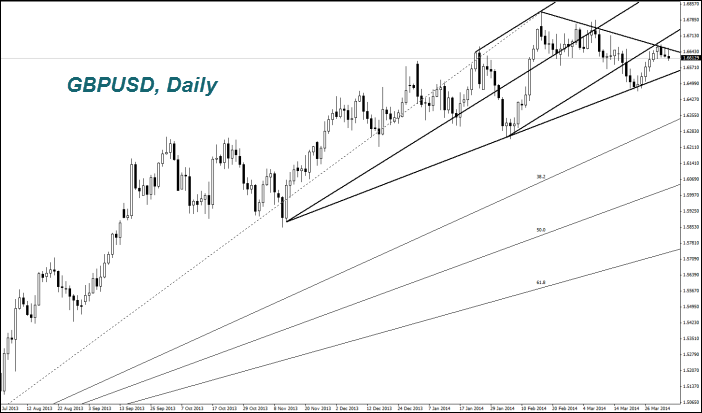

The British Pound ( GBPUSD ) strengthened (growth on the chart ) against both the U.S. Dollar and the Euro. Market participants expect the tightening of monetary policy over the next 12 months. The head of the Bank of England, Mark Carney announced that the interest rate can increase till the next elections (in the second quarter of 2015 ), if there is an increase in jobs . Yesterday though construction PMI for March turned out worse than expected, it was still 62.5 points. That calmed investors and supported the Pound. Prior to this, weak PMI manufacturing was released on Tuesday for March, as well. Today at 10:30 CET PMI Services and Composite PMI will be released. The forecast is neutral . On Friday no economic data will be in the UK, and the next will be released only on April 10th.

The value of grain futures fell because of rainy weather all over the world, from Australia to the Great Plains of the U.S. and southern Russia. Market participants believe that this can increase the harvest. The sugar rates (Sugar) stopped declining after inputting anti-dumping restrictions on Mexican sugar to the U.S..

News

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works....

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also