- Analytics

- Technical Analysis

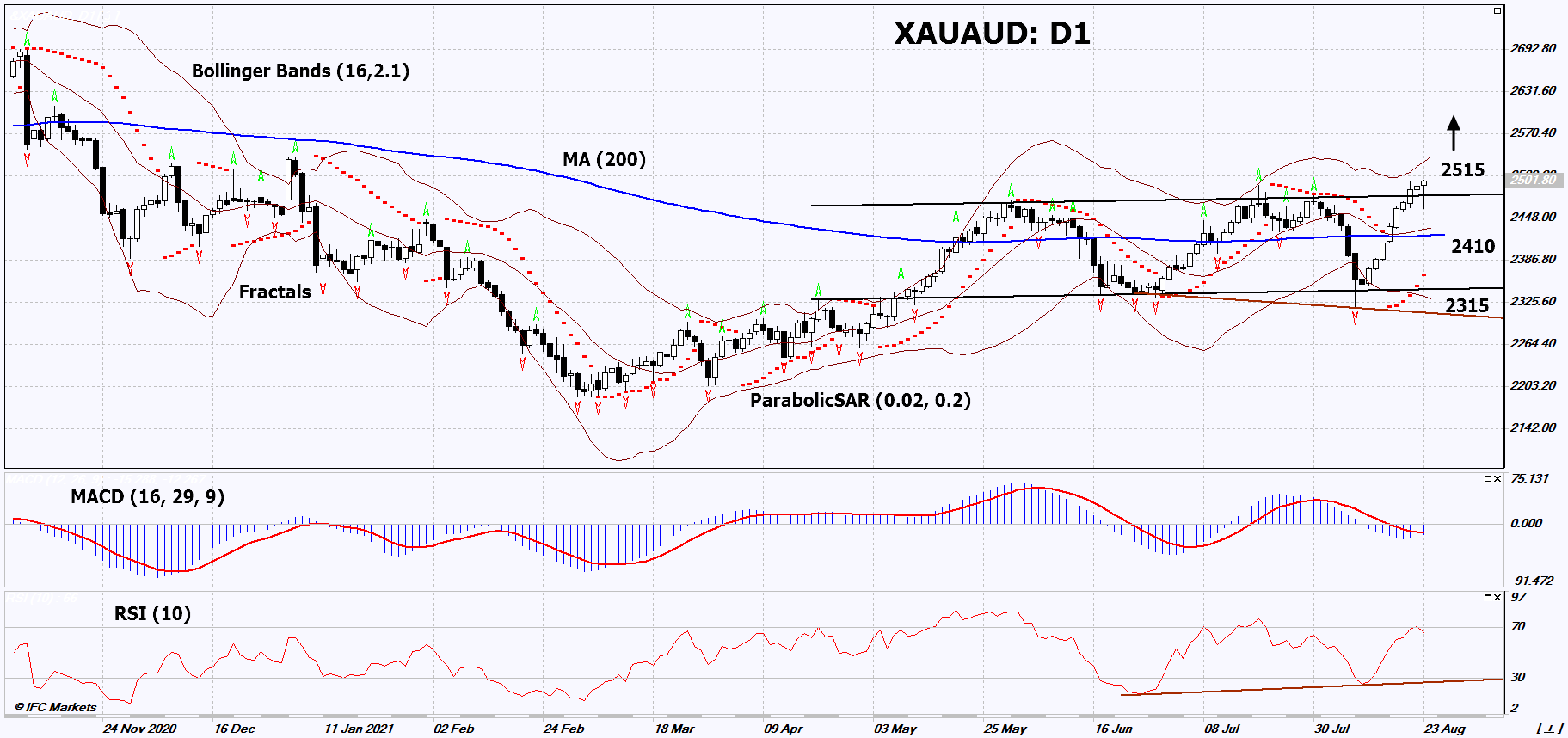

Gold vs AUD Technical Analysis - Gold vs AUD Trading: 2021-08-24

XAU AUD Technical Analysis Summary

Above 2515

Buy Stop

Below 2410/2315

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

XAU AUD Chart Analysis

XAU AUD Technical Analysis

On the daily timeframe, XAUAUD: D1 went up from the neutral, parallel channel. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if XAUAUD rises above its last high, the Upper Bollinger Band and: 2515. This level can be used as an entry point. The initial risk limitation is possible below the 200-day moving average line or below the Parabolic signal, the lower Bollinger line and the last lower fractal: 2410 or 2315. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (2410 or 2315) without activating the order (2515), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Fundamental Analysis of PCI - XAU AUD

In this review, we propose to consider the XAUAUD Personal Composite Instrument (PCI). It reflects the price action of gold against the Australian dollar. Will the XAUAUD quotes continue to rise?

The upward movement is observed with an increase in the price of gold and a weakening of the Australian dollar. In Australia, the Commonwealth Bank Australia Manufacturing Purchasing Managers Index for August was released Monday, which turned out to be weak. It amounted to 51.7 points, which is much less than the forecast of 56.7 points. This economic indicator has dropped to a minimum since June 2020. A slowdown in economic recovery could be a negative factor for the Australian dollar. Australia is due to release significant retail sales data on August 27. Gold has risen in price ahead of the next annual U.S. symposium Federal Reserve at Jackson Hole on August 26-28. Some investors fear that the US regulator will maintain a soft monetary policy. An additional factor in the rise in prices for precious metals could be a sharp decline in new cases of coronavirus in China to almost zero. Market participants expect this to increase demand for jewelry, as well as precious metals in the electronics, chemical and automotive industries.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.