- Analytics

- Fundamental Analysis

- UnitedHealth Group Q1 earnings preview

Mixed technical and Fundamental signals

United American Healthcare Corp (UAHC), the second-largest healthcare company after CVS Health and the largest insurance company by the market value of $332.885 planning to release its Q1 2021 earnings report on 15 April before the opening bell. For Minnesota-based UAHC in 1974, Zacks Consensus Estimate for the company's first-quarter earnings per share is $4.41, nearly 18.5% above the year-ago quarter's reported figure.

Revenues estimate is $69 billion, 7.1% more than the prior-year quarter's reported number.

What do we need to focus on in the report?

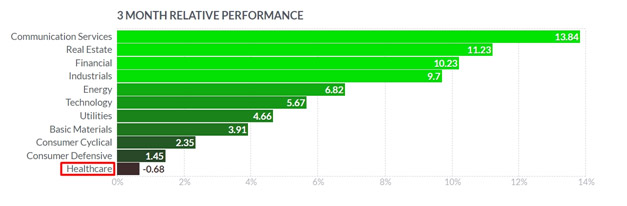

In the past three months, the healthcare group had the weakest performance comparing other groups, as you can see in the bellow figure from Finviz.com.

Company generally has two Organizational structures, Optum and UnitedHealthcare. The Optum as a technology-focused arm was created back in 2011 as a health services business. And UnitedHealthcare includes four divisions. UnitedHealthcare Employer and Individual, UnitedHealthcare Medicare and Retirement, UnitedHealthcare Community and State, and UnitedHealthcare Global.

As the company has the activities in different directions, we have to check their results separately for the report.

The number of individual workers in the Medicare Advantage business, market shares of its Medicaid business, and the older markets' extension are the main points we have to observe. On the Optum front, the growth in value-based care systems and the extension of ambulatory care surgery service lines also must be carefully watched in the report. "The Zacks Consensus Estimate for Optum's first-quarter revenues is pegged at $34.5 billion, suggesting growth of 5.2% from the prior-year quarter's reported figure."

On the other hand, a huge increased number of Covid-19 related clients in the first three months, especially in the first two months of 2021, must help report results; however, this advantage must be ease in next quarter.

Technical overview - H1 Chart

The technical chart shows a tendency to start a downtrend; however, it is slower on a pivot point, where yesterday's price closed (375.90). First resistance at 378.30 and the first support 373.00 created a range, and the next trend needs to be out of this range. $367 and $383 are the S3 and R3 in negative and positive reports, while technical indicators have mixed signals.