- Analytics

- Market Overview

Fed expected to leave rates unchanged today - 1.8.2018

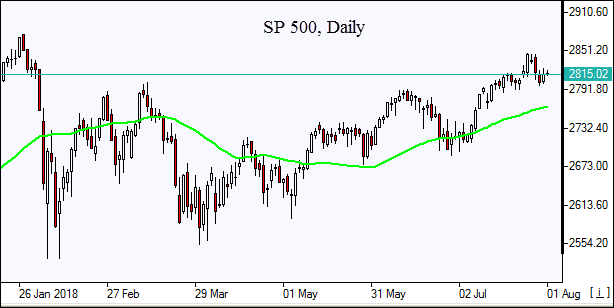

S&P 500 logs 4th straight monthly gain

US stock indices rebounded on Tuesday as the two-day Fed policy meeting started. The S&P 500 ended 0.5% higher at 2816.29, with eight of the 11 main sectors finishing higher. The broad market index rose 3.6% over month, the fourth straight monthly gain. Dow Jones industrial average added 0.4% to 25414.78. The Nasdaq composite index rose 0.6% to 7671.79. The dollar also rebounded: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 94.527 and is higher currently. Stock index futures indicate mixed openings today.

The Fed will release a statement at 20:00 CET today, there will be no press conference by Fed chair Powell or new economic forecasts. The central bank is expected to hold rates steady in the range between 1.75% and 2% and restate that more rate hikes are coming, as soon as the Fed’s next meeting on September 25-26. Policy makers’ interest rate projections at Fed’s last meeting showed central bank officials expect two more rate hikes this year and three in 2019. Trade war concerns were highlighted by news that the Trump administration made little progress in resolving its trade dispute with China. Economic data were positive: inflation remained at 2.2% in June, the 0.4% gain in June consumer spending was solid, in line with expectations. The employment cost index rose 0.6% in the second quarter, missing the 0.7% increase forecast.

FTSE 100 leads major European indices recovery

European stocks recovered Tuesday helped by positive corporate earnings reports. Both the euro and British Pound’s turned lower against the dollar and are down currently. The Stoxx Europe 600 gained 0.2% in a choppy session. The German DAX 30 added 0.1% to 12805.50. France’s CAC 40 gained 0.4% and UK’s FTSE 100 rose 0.6% to 7748.76. Indices opened mixed today.

Swiss lender Credit Suisse’s better than expected earnings report was the highlight of positive corporate reports: company’s second-quarter net profit more than doubled to 647 million Swiss francs, beating expectations of 596 million Swiss francs. In economic news euro-zone inflation for July rose to 2.1% from 2% in June. Inflation was expected to remain steady at 2% year-over-year.

Chinese shares lead Asian indices losses

Asian stock indices are mostly lower today after late Tuesday reports the US plans tariffs of 25% on $200 billion in Chinese imports. Nikkei however gained 0.9% to 22775.47 as the yen continued to retreat against the dollar. Chinese stocks are falling as Caixin China manufacturing PMI hit 8-month low: the Shanghai Composite Index is down 1.5% and Hong Kong’s Hang Seng ndex is 0.6% lower. Australia’s All Ordinaries Index is down 0.1% despite Australian dollar’s turn lower against the greenback as data showed a slowdown in manufacturing activity in July with.

Brent down on US stocks unexpected build

Brent futures prices are extending losses today on easing of Iranian oil concerns and expectations of rising US crude stocks. The American Petroleum Institute reported late Tuesday that US crude inventories jumped unexpectedly by 5.6 million barrels. Prices ended lower yesterday: September Brent fell 1% to $74.25 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also