- Analytics

- Market Overview

Global equities retreat on escalating trade war fears - 20.6.2018

Dow falls sixth session in a row

US stocks continued retreating Tuesday after President Trump’s Monday threat of additional $400 billion in tariffs on Chinese goods if China didn’t revoke its retaliatory tariffs on US goods. The S&P 500 ended 0.4% lower at 2762.57. Dow Jones industrial average dropped 1.2% to 24700.21. The Nasdaq composite index fell 0.3% to 7725.59. The dollar strengthening resumed as housing starts in May were above expected, hitting 11-year high: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 94.989 and is up currently. Stock index futures point to higher openings today.

DAX still biggest loser as European indices fall

European stock indices extended losses Tuesday as US-China tariff war escalated after President Trump said he ordered drawing up list of Chinese goods for additional $200 billion tariffs if China doesn’t cancel its retaliatory tariffs. The euro joined British Pound’s slide against the dollar and both currencies are receding currently. The Stoxx Europe 600 lost 0.7%. The German DAX 30 dropped 1.2% to 12677.97. France’s CAC 40 fell 1.1% and UK’s FTSE 100 lost 0.4% to 7603.85. Indices opened 0.3% - 0.7% higher today.

Asian indices recover

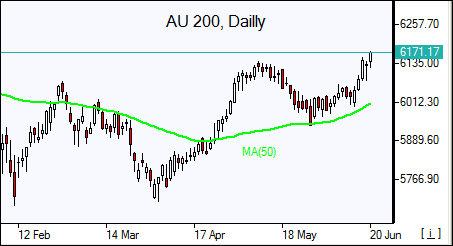

Asian stock indices are mostly higher today despite continued US-China trade dispute. Nikkei gained 1.2% to 22555.43 as the yen slide against the dollar resumed. Chinese stocks are rising after China's central bank said the country should cut banks' reserve requirement ratios to boost market liquidity: the Shanghai Composite Index is up 0.3% and Hong Kong’s Hang Seng Index is 0.6% higher. Australia’s All Ordinaries Index is up 1.2% despite Australian dollar turning higher against the greenback.

Brent up

Brent futures prices are recovering today on expectations of US crude stockpiles draw and Libya supply disruption concern. The American Petroleum Institute reported late Tuesday that US crude inventories fell by 3 million barrels to 430.6 million. Prices ended lower yesterday: August Brent fell 0.4% to $75.08 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also