- Analytics

- Market Overview

Global equities volatile as Turkish lira in crisis - 14.8.2018

SP 500 logs fourth straight loss

US stock market slide continued on Monday led by energy and materials shares. The S&P 500 lost 0.4% to 2821.93. Dow Jones industrial fell 0.5% to 25187.70. The Nasdaq composite index slid 0.3% to 7819.71. The dollar strengthening stalled: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched lower 0.04% to 96.287 but is lower currently. Stock index futures point to higher openings today.

Possibility of global financial contagion after the plunge of Turkish lira following US doubling of tariffs on steel and aluminum imports from Turkey last week has undermined investors’ confidence worldwide. With positive earnings reports and economic data attesting to US economic health the trade war news is the main market driver.

DAX 30 opens higher than main European indices

European stocks extended losses on Monday as investors worried about negative impact of Turkish lira crisis on European banks. The GBP/USD continued the decline while EUR/USD edged higher and both pairs are moving higher currently. The Stoxx Europe 600 index lost 0.3%. The DAX 30 dropped 0.5% to 12358.74 and France’s CAC 40 fell less than 0.1%. UK’s FTSE 100 slipped 0.3% to 7642.45. Indices opened 0.2% - 0.7% higher today.

Markets are under stress on concerns about spreading of Turkey’s financial turmoil to its partners. The Turkish central bank assured its banks would be able to borrow foreign-exchange deposits from the central bank at one-month and one-week maturities while it refrained from raising interest rates.

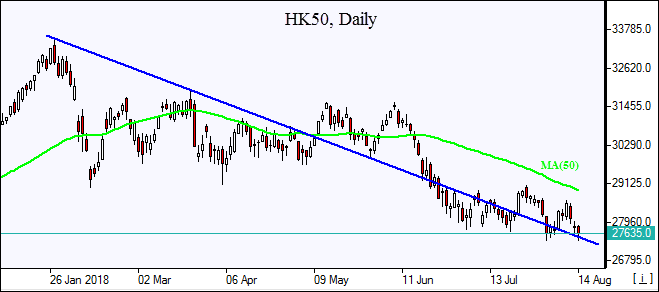

Asian indices mixed after weak China industrial data

Asian stock indices are mixed today. Nikkei gained 2.3% to 22356.08 as yen slide against the dollar continued. Chinese stocks are retreating after data showed retail sales, industrial output and urban investment all grew by less than forecast in July: the Shanghai Composite Index is down 0.2% and Hong Kong’s Hang Seng Index is 0.6% lower. Australia’s All Ordinaries Index is up 0.8% as the Australian dollar slide against the greenback slowed.

Brent rises

Brent futures prices are recovering today after an OPEC report top exporter Saudi Arabia had cut production. Saudi Arabia indicated it had curbed production by 200,000 barrels per day (bpd) to 10.288 million bpd in July. October Brent crude settled 0.3% lower at $72.61 a barrel on Monday.

See Also