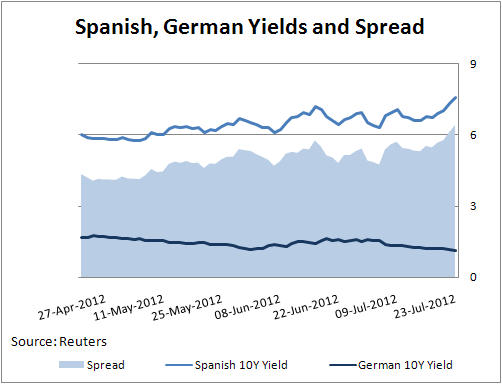

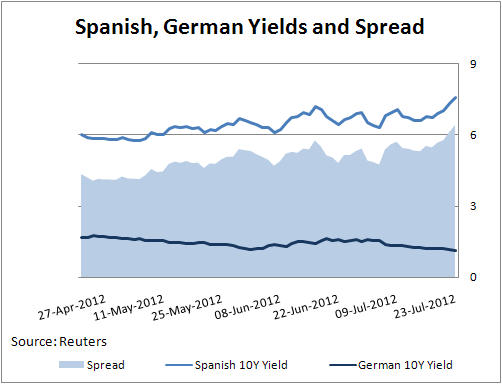

The euro weakened to a 2-year low against the dollar, touching 1.2066 in European trading, as concern mounted that European leaders are failing to gain control of the region’s debt crisis. The single currency remains under pressure amid continuing contrast in the European debt market. Spanish government bond maturing in 10 years fell further today, lifting the yields to 7.57% before the nation sells short term bills tomorrow. On the other hand the benchmark 10 year German debt yield fell to 1.14%, the spread reached 643 points.

The turmoil in Europe, along with signs of weakening global growth may set even more pressure on the single currency in the coming weeks. Tomorrow’s purchasing managers’ data from Europe, German consumer prices at the end of the week and the long-awaited GDP report from the United States on Friday are expected to be the next determinants of the market.