- Analytics

- Market Overview

The Dollar Index made significant fluctuations on Friday, but, as a result, remained almost unchanged - 10.3.2014

Note that there was a noticeable weakening of the Japanese Yen (rise on the chart) on Friday due to weak macroeconomic information. The GDP growth in the fourth quarter was worse than expected and amounted to 0.7% in annual terms. The current account deficit was also weaker than it had been expected. This is especially negative for export-oriented Japanese economy. However, the data from China have caused a change towards the Yen and it strengthened its position today (fall in the chart). Investors see the Yen as a safe heaven currency in the case of economic problems in China. This week macroeconomic data will be brought from Japan everyday, so the Yen can be quite volatile. Now market participants are focused on the results of the BOJ meeting, which will be announced on Tuesday. It is expected to continue easing the monetary policy aimed at weakening the exchange rate: emission 60-70 trillion Yen per year to redeem Japanese government bonds and the sales tax increase from 5% to 8% since April 1st. Because of the fall in Chinese exports, the Copper price in Shanghai on Friday fell by 5% to its lowest level in more than four years. Meanwhile, imports of Copper to China in January-February 2014 increased by 41.2% to 915 thousand tons compared to the previous year. Therefore, we believe that falling prices may be short-lived. China consumes 45% of world's Copper production. It is not excluded that the quotations were also affected by the first corporate default on the bonds in China in addition to weak exports. The solar energy equipment manufacturer, Solar Shaori did not pay any percentage on its debt securities. The Copper is actively used in the industry.

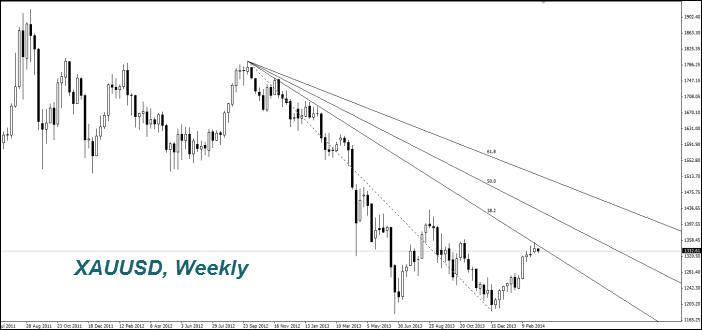

The Gold (XAUUSD) comes cheaper for the second consecutive day. Investors believe that the U.S. labor market data is acceptable for further economic growth. The political situation has been stabilized around Crimea partly on anticipation of a general referendum of its residents on March 16th. It will decide the future status of the peninsula. An additional factor of reducing the Gold price are the signs of a slowdown in Chinese economy. Meanwhile, according to the U.S. Commission on Commodity Futures Trading (CFTC), the number of net long positions on the Gold (net-long) last week increased by 3.8% to the highest level since December 2012, 118.2 thousand contracts. In this regard we can not exclude the resumption of growth in the Gold prices after the correction.

News

Iran Secret Overture to the CIA

A day after US and Israeli strikes began raining down on Iranian...

Why China Wins When Oil Prices Spike

Key Takeaways The Paradox - China's import dependence doesn't...

TikTok is Being Gutted for AI Data and Advertisers

TikTok is no longer the company it once was. From a creator centric...

S&P 500 Outlook: Valuations, Real Yields, and the AI Hype

S&P 500, as we all have been saying too many times, is moving...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also