- Analytics

- Market Overview

US earnings season starts today - 11.10.2017

Dow closes at new record high

US stocks resumed the rally on Tuesday on expectations of strong earnings season. The dollar weakening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.5% to 93.25. The S&P 500 added 0.2% settling at 2550.64 led by consumer staples stocks. Nine out of 11 main sectors finished higher. Dow Jones industrial average rose 0.3% closing at fresh all-time high 22830.68, led by 4.5% jump in Wal-Mart shares. The Nasdaq composite index gained 0.1% to 6587.25.

Treasury yields inched lower ahead of earnings season which starts today with reports from BlackRock and Delta Air Lines. Investors expect a strong quarter of earnings following recent quarters of better than expected corporate results. Traders will be watching also the Federal Open Market Committee meeting minutes which will be released at 20:00 CET today. More hawkish than expected minutes may support the dollar. The Federal Reserve announced at last FOMC meeting it will start shrinking its $4.5 trillion balance sheet this month.

European stocks slip

European stocks closed marginally lower on Tuesday ahead of Catalonia President regional parliament speech. Both the euro and British Pound extended gains against the dollar. The Stoxx Europe 600 slipped 0.01%. German DAX 30 fell 0.2% closing at 12949.25 despite positive exports data. France’s CAC 40 closed less than 0.1% lower while UK’s FTSE 100 rose 0.4% to 7538.27. Markets are trading higher after opening today.

Spanish stocks fell as investors were uncertain whether the Catalan president will declare independence or opt for negotiations with Madrid. At a closely watched address after markets closed Catalan president Puigdemont said he accepted the mandate of forming a Catalan republic but refrained from declaring outright independence in an effort to engage in mediation with Madrid. Euro accelerated the rise against the dollar which was supported also by ECB executive board member Lautenschlaeger hawkish comment Monday the central bank should start scaling back its massive bond buying program next year. In economic news German exports surged in August 7.2% from the same month in 2016 due to strong demand from the euro-zone, while French industrial production unexpectedly fell 0.3% on month in August.

Asian markets rise

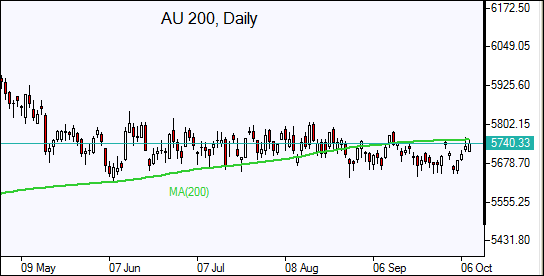

Asian stock indices are rising today following strong lead from Wall Street overnight. Nikkei rose 0.3% to 20881.27 with yen little changed against the dollar. Chinese stocks are higher: the Shanghai Composite Index is 0.3% higher and Hong Kong’s Hang Seng Index is little changed. Australia’s All Ordinaries Index gained 0.6% as Australian dollar pared earlier gains against the greenback.

Oil advances

Oil futures prices are extending gains today on signs of rising demand as global economic growth improves and OPEC output cut deal helps rebalance the supply glut. The International Monetary Fund forecasted global economic growth would accelerate to 3.7% in 2018 from 3.6% this year. The American Petroleum Institute industry group will report later today US crude stocks. Prices rose yesterday on lower US oil output as nearly 59% of US Gulf of Mexico oil production remained off line on Tuesday. December Brent crude rose 1.5% to $56.61 a barrel at ICE Futures exchange in London on Tuesday.

See Also