- Analytics

- Market Overview

US stocks slip from all-time highs - 22.9.2017

Dow snaps nine session winning streak

US stocks slipped on Thursday led by consumer staples and technology shares. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 92.163. Dow Jones industrial average lost 0.2% to 22419.51 snapping nine-session winning streak, weighed by Procter & Gamble and Apple shares. The S&P 500 fell 0.3% settling at 2500.60 with nine out of 11 main sectors closing lower. The Nasdaq index dropped 0.5% closing at 6422.69.

Stocks retreated a day after the Federal Reserve announced it would start reducing its $4.5 trillion balance sheet in October and signaled plans for another rate hike in 2017 and three more rate hikes in 2018. Positive economic data were shrugged off by markets: initial jobless claims fell sharply despite an expected spike following recent hurricanes. And the Philadelphia Fed manufacturing index rose more than expected to a reading of 23.8, a three-month high, from 18.9 in August.

Banks lead of European markets higher

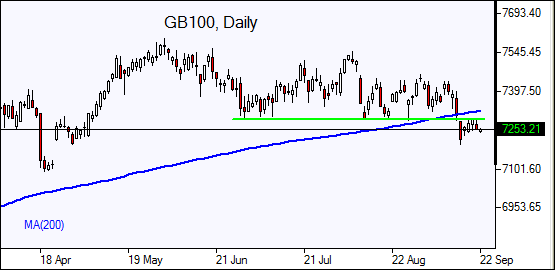

European stocks advanced on Thursday led by bank shares. Both euro and British Pound resumed climbing against the dollar. The Stoxx Europe 600 closed 0.2% higher. Germany’s DAX 30 rose 0.3% to 12600.03. France’s CAC 40 outperformed gaining 0.5% while UK’s FTSE 100 fell 0.1% to 7263.90. Indices opened 0.2% lower today.

Asian markets lower after North Korea bomb test threat

Asian stock indices are mostly lower today after North Korea threatened to test a hydrogen bomb in the Pacific Ocean. Nikkei ended lower 0.3% at 20296.45 as yen gained against the dollar on the back of strong haven demand.. Chinese stocks are down after S&P Global Ratings downgraded China's long-term sovereign credit rating on Thursday citing increasing risks from heavy debt load: the Shanghai Composite Index is down 0.2% and Hong Kong’s Hang Seng Index is 0.7% lower. Australia’s All Ordinaries Index managed to rise 0.4% as the Australian dollar extended losses against the greenback after Australia’s central bank governor Lowe’s comment Thursday the central bank does not have to follow a general move globally to raise interest rates.

Oil higher ahead of OPEC meeting

Oil futures prices are inching higher ahead of a meeting of major oil producers today as they are expected to discuss the production cuts agreement progress and possibly extend the agreement beyond March 2018. Prices rose yesterday: Brent for November settlement rose 0.3% to end the session at $56.43 a barrel on the London-based ICE Futures exchange on Thursday.

See Also