- Analytics

- Technical Analysis

GBP USD Technical Analysis - GBP USD Trading: 2016-06-03

Uncertainty about European Union membership not helping Pound

The UK economy growth slowed in the first quarter compared with the final quarter of 2015. The rise in UK consumer prices in April was lower than inflation in the prior month. The manufacturing PMI rose in May, and services PMI is expected to come in higher for May. Will the Pound continue weakening?

The Bank of England left the interest rate unchanged at 0.5% and kept the volume of asset purchases at 375 billion Pounds annually at its May 12 meeting. The GDP growth fell from 0.6% quarter-over-quarter in the last quarter of 2015 to 0.4% in the first quarter of 2016. Expanding consumption, which accounts for half of gross domestic product, underpinned UK growth with private consumption growing 0.7% in first quarter following an 0.6% rise in fourth quarter. 0.4% growth in government spending compared with the 0.3% increase in fourth quarter and a 0.5% expansion in fixed capital formation also contributed to GDP growth. The economic growth slowed due to weakened external demand. Exports fell 0.3% in first quarter compared to 0.1% expansion in fourth quarter while imports grew 0.8% compared with an 0.9% rise in fourth quarter. The financial uncertainty surrounding the possible exit of the country from European Union after a referendum on June 23 remains the significant short term risk for UK’s economic outlook and Pound weakens as opinion polls suggest rise in votes supportive of EU exit. Consumer price inflation at 0.1% in April was lower than the 0.4% increase in March and consumer credit, mortgage lending and mortgage approvals declined, which is bearish for Pound. However manufacturing activities expanded in May following contraction in April and construction sector grew at a slower pace compared with prior month’s growth as evidenced by respective PMIs. Today May services PMI is expected to show services sector continued to expand, which will support bullish Pound sentiment. At the same time May jobs report is due today in US and a strong labor market report will boost the US dollar and pressure the Pound while a negative surprise will be bullish for Pound. Next important economic reports are due on June 9 and 14 when the Office of National Statistics releases April balance of trade and May inflation.

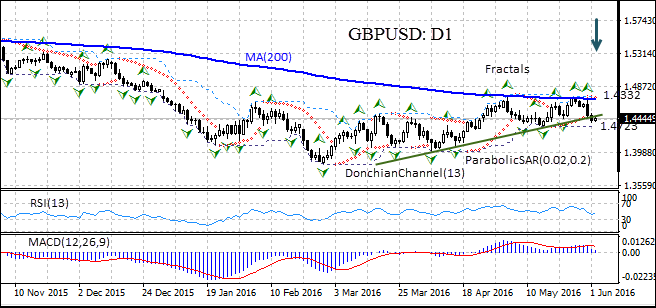

The GBP/USD has been correcting downward after the release of disappointing GDP report a week ago. The price had been trading in a range in the last month, unable to close above the 200-day moving average MA(200) and the high reached at the start of May after rising for the most part of April. It has closed below the support line of the uptrend and the Parabolic indicator has formed a sell signal. The RSI oscillator is below the 50 level and is edging higher. The Donchian channel is tilted upward which is a bullish signal. The MACD indicator is above the signal line and the zero level but the gap is narrowing which is a bearish signal. We believe the bearish momentum will continue after the price closes below the lower Donchian channel at 1.4332 which can serve as a point of entry. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at 1.47231. After placing the pending order the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (1.47231) without reaching the order(1.4332), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Sell |

| Sell stop | below 1.4332 |

| Stop loss | above 1.47231 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.