- Analytics

- Market Overview

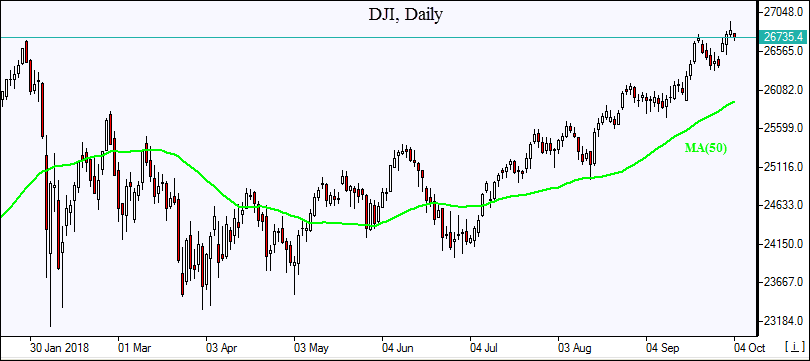

Dow logs second record close in a row - 4.10.2018

Dollar boosted by data

US equities resumed growth on Wednesday buoyed by upbeat data. The S&P 500 edged up 0.1% to 2925.51. The Dow Jones industrial average rose 0.2% to fresh record 26828.39, the fifteenth record in 2018. Nasdaq composite index gained 0.3% to 8025.09. The dollar strengthening accelerated on reports ISM’s Nonmanufacturing PMI jumped to 61.6 in September, above forecasts of 58: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.5% to 95.973 and is rising currently. Futures on stock indices indicate lower openings today.

DAX 30 opening loss smaller than main European indices

European stocks rebounded on Wednesday on reports Italy’s budget deficit would be trimmed faster than expected. Both the EUR/USD and GBP/USD continued falling, EUR/USD is lower currently while GBP/USD has turned higher. The Stoxx Europe 600 rose 0.5%. German markets were closed for a holiday. France’s CAC 40 climbed 0.4% and UK’s FTSE 100 gained 0.5% to 7510.28. Markets opened 0.1% - 0.3% lower today.

Investors’ confidence was buoyed by reports Italy’s budget deficit, set at 2.4% of GDP in 2019 by the coalition government, is planned to decline to 2.2% in 2020 and 2.0% in 2021.

Asian indices pull back

Asian stock indices are mostly lower today in volatile trade as markets in mainland China remained closed for a holiday. Nikkei ended 0.6% lower at 23975.62 as yen turned higher against the dollar. Hong Kong’s Hang Seng Index is sharply lower, down 1.8% after JPMorgan downgraded China’s outlook. Australia’s All Ordinaries Index however extended gains 0.5% as the Australian dollar’s slide against the greenback persisted.

Brent rally continues

Brent futures prices are extending gains today on increased bullish bets that US crude oil could surge to $100 a barrel by next year as US sanctions are re-imposed on Iran in November. Prices rallied yesterday despite the Energy Information Administration report of increase in US crude stockpile: domestic crude supplies jumped by 8 million barrels. December Brent crude rose 1.8% to $86.29 a barrel on Wednesday.

See Also