- Analytics

- Market Overview

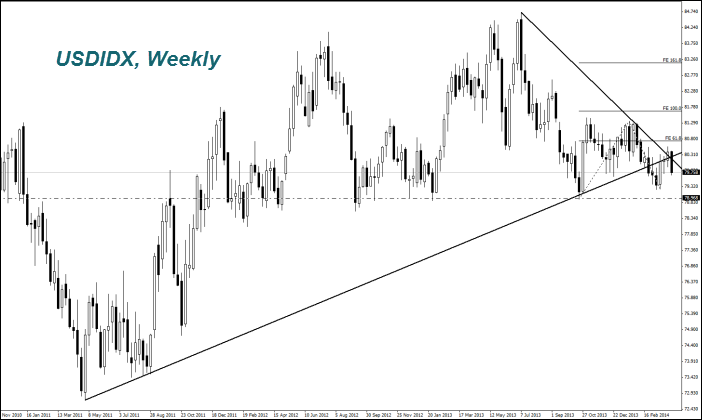

The U.S. Dollar trend continued weakening on Tuesday - 9.4.2014

The Australian Dollar (AUDUSD) continued its growth (strengthening) and updated its 5-month high. The macroeconomic data were much better than the preliminary forecasts. The Consumer Confidence index rose in April for the first time in five months. The lending volume in the real estate market increased in February. Even more important factor for the Aussie strengthening was the information from the Japanese Ministry of Finance. The Net buying of financial assets by Japanese investors denominated in the Australian Dollars in February amounted to A $1.1B and A $6,5B for the period from October of last year. Such large volumes are quite understandable. After Australian 2-year government bonds yield is 2.94% per annum and lower than 0.1% for exactly the same Japanese bonds. Largely due to purchases Japanese investors purchases, the AUD grew by 8% vs. the JPY since early February. It is hard to say how long this rally will last. We do not exclude correction by the Aussie if investors get disappointed by the provisional inflation data for April and unemployment for March in Australia coming out tomorrow early in the morning at 2-00 and 2-30 CET. The growth of the number of new jobs for March is projected to be less than in February.

Tuesday's economic data in the UK were positive in spite of the weak preliminary forecasts. The Pound (GBPUSD) refreshed its monthly high due to increase in Industrial Production by 2.7% for February (YoY) that was more than expected. Investors believe that this figure increases the likelihood of raising the discount rate by the BOE in the first half of next year, but not in the second one, as it was previously thought. An additional positive factor for the GBP was the GDP growth forecast for this year from 2.4% to 2.9 % from the IMF. Today at 9:30 CET we will find out about the UK trade balance in February. In our opinion the prognosis is moderately positive. However the strong movement hardly can be expected. As investors await the results of tomorrow BOE meeting.

The Canadian Dollar (USDCAD) unexpectedly strengthened (fall in the chart) in spite of the weak Real Estate market data. The number of Housing Starts collapsed in March by 17.7%, while the Building Permits turned out 11.6% in February. Note that the Canadian Real Estate market has avoided a large-scale collapse by the example of the U.S. in 2008-2009. Some market participants do not exclude that it still could happen. The Brent Oil went up yesterday to its monthly maximum. The U.S. Energy Information Administration raised its forecast for growth in the daily world Oil demand in 2014 by 10 thousand barrels to 1.23 million barrels a day compared to 2013 year. So the world consumption this year will amount to 92 million barrels of oil per day. It is expected that the oil growth in 2015 will amount to 1.36 million barrels per day. As we mentioned in previous reviews, the Oil quotes are in the long-term uptrend. The global demand since 2008 rose by 8.5%. However, a steady increase in the Oil prices is possible only after the situation in Ukraine is normalized.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also