- Analytics

- Market Overview

SP 500, Nasdaq break 4-day losing streak - 11.9.2018

Technology shares rebound

US stock market rebounded on Monday as technology sector halted its decline. The S&P 500 gained 0.2% to 2877.13 with eight of the 11 primary industry sectors finishing higher. Dow Jones industrial though slipped 0.2% to 25857.07. The Nasdaq composite index rose 0.3% to 7924.16 after series of losses exacerbated after President Trump indicated US tariffs on imports from China will be widened. The dollar strengthening reversed: live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, slid 0.3% to 95.11 and is lower currently. Futures on three main US stock indices indicate higher openings today.

Main European indices open higher

European stocks extended gains on Monday shrugging off the election results in Sweden where a euroskeptic party won parliament seats. The GBP/USD turned higher at EU negotiator Michel Barnier’s estimate a Brexit deal could be agreed to within six to eight weeks. The EUR/USD reversed the slide as Italy’s finance minister signaled willingness to abide by the European Union’s budget deficit rules. Both pairs are moving higher currently. The Stoxx Europe 600 index gained 0.4%. The DAX 30 rose 0.2% to 11986.34 while France’s CAC 40 climbed 0.3%. UK’s FTSE 100 added less than 0.1% to 7279.30. Indices opened flat to 0.2% higher today

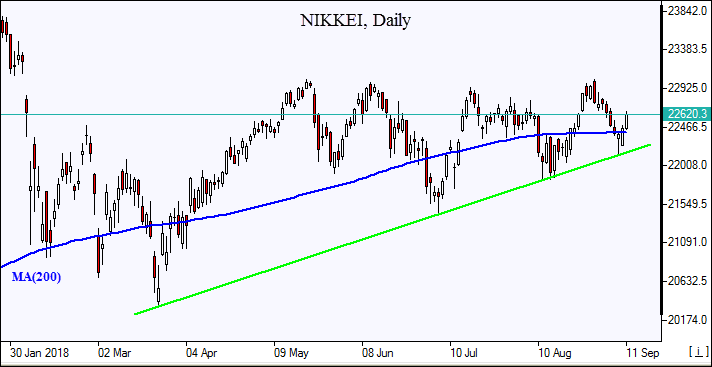

Asian indices remain subdued

Asian stock indices are mostly lower today as trade war uncertainty persists. Nikkei however jumped 1.3% to 22664.69 helped by accelerated yen slide against the dollar. Chinese stocks are lower as foreign ministry said China will respond to US tariff measures: the Shanghai Composite Index is down 0.2% and Hong Kong’s Hang Seng Index is 0.5% lower. Australia’s All Ordinaries Index turned 0.6% higher despite the continued Australian dollar rebound against the greenback.

Brent up

Brent futures prices are gaining today on expectations of output shortage from Iran sanctions despite US urge to OPEC producers to increase output to make up for declining Iranian exports. Prices extended gains yesterday: November Brent crude settled 0.7% higher at $77.37 a barrel on Monday.

See Also