- Analytics

- Market Overview

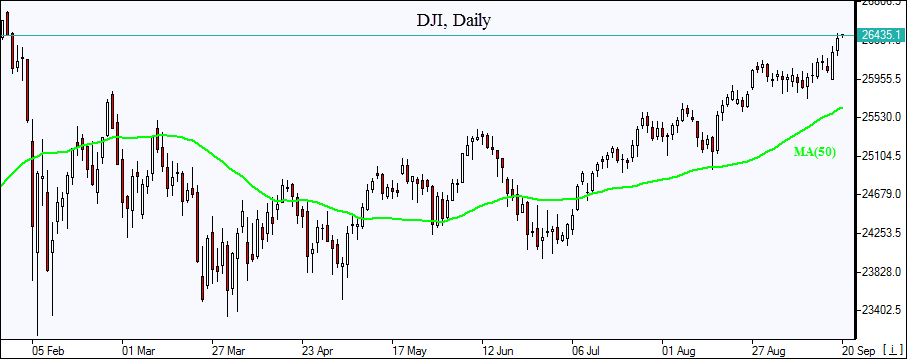

US stocks edge higher on positive data - 20.9.2018

Dollar falls despite narrowing of current account deficit

US stock market extended gains on Wednesday as more positive data supported market sentiment while technology shares pulled back. The S&P 500 added 0.1% to 2907.95 led by financial shares up 1.8%. The Dow Jones industrial average rose 0.6% to 26405.76. Nasdaq composite index however lost 0.1% to 7950.04. The dollar strengthening reversed despite the Bureau of Economic Analysis report US current account deficit fell 17% in the second quarter and hit the lowest level in three years: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.5% to 94.527 and is falling currently. Futures on stock indices point to higher openings today.

European stock markets open flat

European stocks added to previous session gains on Wednesday. The GBP/USD ended lower after initial boost following report UK inflation jumped to a six-month high of 2.7%. The EUR/USD’s climb continued and both pairs are higher currently. The Stoxx Europe 600 rose 0.3%. Germany’s DAX 30 gained 0.5% to 1219.02. France’s CAC 40 climbed 0.6% and UK’s FTSE 100 ended higher 0.4% at 7330.11. Indices opened flat today

Asian indices mixed

Asian stock indices are mixed today in cautious trade as trade war concerns linger after President Trump restated the US had “no choice” but to levy another $267 billion in duties on China. Nikkei ended 0.01% higher at 23674.93 as yen turned higher against the dollar. China’s stocks are mixed while Chinese Premier Li Keqiang said on Wednesday that the government will continue to lower import tariffs on some goods: the Shanghai Composite Index is down 0.1% and Hong Kong’s Hang Seng Index is 0.3% higher. Australia’s All Ordinaries Index however fell 0.3% with the Australian dollar steady against the greenback.

Brent gains on US inventories fall

Brent futures prices are edging higher today after gains yesterday following the Energy Information Administration report of surprise decline in US crude stockpile. Domestic crude supplies fell by 2.1 million barrels while the American Petroleum Institute on Tuesday reported an increase of 1.25 million barrels. Prices ended higher yesterday: November Brent crude rose 0.5% to $79.40 a barrel on Wednesday.

See Also