- Education

- Forex Trading Strategies

Forex Trading Strategies

What is Forex Trading Strategy

In a highly volatile market where prices move rapidly, traders are in dire need of something tangible to rely on, here comes forex trading strategies. Forex trading strategy is a technique used by forex traders to help decide whether to buy or sell a currency pair at any given time. In trading, you may need our other article about "What is Forex Trading and How does it Work".

Forex trading strategies can be based on either technical analysis, fundamental analysis, or both. Strategies usually build on Forex trading signals, which are in their essence triggers for actions. There are well known forex trading strategies that can be easily found or traders themselves can construct their own. You may also be interested in one of the most popular trading instrument - cryptocurrency trading. To improve your knowledge of crypto trading you can learn cryptocurrency trading strategies.

Types of Trading Strategies

Swing trading

This strategy is a long term trading strategy, when trades are kept open from a few days to, sometimes, several weeks. Swing trading strategy’s essence is taking advantage of market big fluctuations "swings".

Fundamental analysis plays an important role on longer timeframes. Strong directional moves are often triggered by important or unexpected market news, such as corporate income statements or central bank meetings, which means swing traders need to be aware of market fundamentals.

There are ways to develop a reliable trading plan. Here are the most common swing trading techniques we’d like to share with you.

Swing Trading Tactics previews

- Moving average crossovers - When the shorter-term MA crosses above the longer-term MA, it's a buy signal, as it indicates that the trend is shifting up. This is known as a "golden cross."

- Cup-and-handle patterns - A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. A cup and handle is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long.

- Head and shoulders patterns - A head and shoulders pattern is a technical indicator with a chart pattern described by three peaks, the outside two are close in height and the middle is highest. A head and shoulders pattern describes a specific chart formation that predicts a bullish-to-bearish trend reversal.

- Flags - Flags are areas of tight consolidation in price action showing a counter-trend move that follows directly after a sharp directional movement in price. The pattern typically consists of between five and twenty price bars. Flag patterns can be either upward trending (bullish flag) or downward trending (bearish flag).

- Triangles - A triangle is a chart pattern, depicted by drawing trendlines along a converging price range, that connotes a pause in the prevailing trend. Technical analysts categorize triangles as continuation patterns.

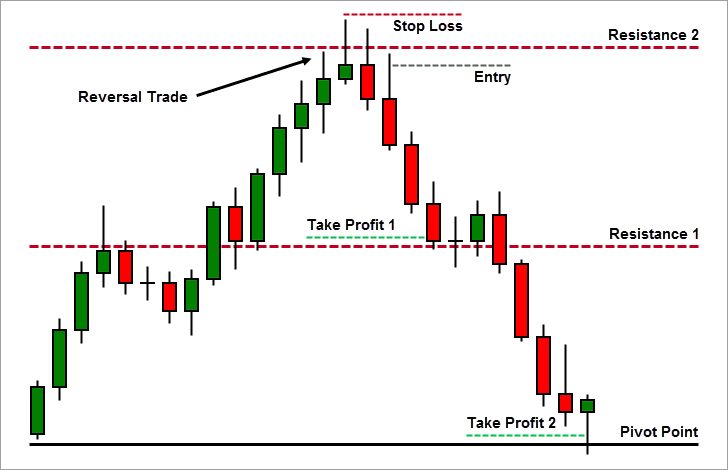

Key reversal candlesticks

Key reversal candlesticks, as well, can be used to complement basic tactics for more accurate execution. A key reversal is a one-day trading pattern that may signal the reversal of a trend. Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

Forex Trading Strategies That Work

There are many circulating Forex trading strategies in trading and sometimes it can be confusing which one to choose. Which one works? Below we will share with you the most successful ones.

These are trading strategies that work well during Forex trading executions.

Scalping trading strategy is very popular in Forex trading Scalpers focus on making profit on small moves that occur frequently and favour markets that aren't prone to sudden price movements. Strategy involves opening a large number of trades in a bid to bring small profits per each. The disadvantage of scalping is that traders can't afford to stay in a trade for too long, plus scalping takes a lot of time and attention to find new trading opportunities.

For example a trader scalping to profit off price movements for Adidas AG Stock trading for $318. The trader will buy and sell a huge amount of Adidas AG shares, let's say 100,000, and sell them during price movements of small amounts. Price increments can be as low as $0.05 or less, making small profits from each share, but since purchase and sale are in bulk, profits could be quite solid.

Day Trading strategy refers to trading during trading day. Quite simple - all trades must open and close during the trading day. Day trading strategy is applicable in all markets, though it's used more in currency trading. When executing day trading strategy, trader monitors and manages open trades the market throughout the whole day.

Note, leaving positions open overnight fraught with loss of money.This type of strategy is often news based, specifically scheduled events - economic news, statistics, elections, interest rates. Basically, one of the ways to execute this strategy is to pay close attention to news that can affect currencies, and act accordingly. That’s why more often than not day traders trade more actively in the mornings, since most news is released at that time.

There are a few unwritten rules day traders should follow to insure themselves from risks:

- Day traders follow a one-percent rule - never put more than 1% of capital or trading account into a single trade. If a trader has $10,000 in a trading account, position in any given instrument shouldn't be more than $100.

- Setting stop loss and take profit points - is the price at which a trader will sell a stock and take a loss on the trade (this happens when trade doesn’t go the way it was planned, in a way it’s a cutting losses approach).

- Setting Take-profit point is the price at which a trader will sell a stock and take a profit on the trade.

Position Trading is a long term strategy, some call it “buy and hold” strategy. During Position Trading strategy traders usually use long term charts, from daily to monthly, and with a combination of other methods establish the trend of the current market. This kind of trade lasts from a few days to several weeks or more. The main idea of position trading strategy is to determine the direction of the market and make use of.

Minor market fluctuations aren't considered important since they don't create trends, hence no impact on position trading strategy, unlike Scalping where the whole strategy is based on it. Since position trading strategy leans on fundamental analysis it's reasonable to monitor central bank monetary policies, political developments as well as long term technical indicators and macroeconomic environment.

Trading Strategies Based on Forex Analysis

Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. These main analysis methods include technical analysis, fundamental analysis and market sentiment.

Each of the mentioned analysis methods is used in a certain way to identify the market trend and make reasonable predictions on future market behaviour. If in technical analysis traders mainly deal with different charts and technical tools to reveal the past, present and future state of currency prices, in fundamental analysis the importance is given to the macroeconomic and political factors which can directly influence the foreign exchange market. Quite a different approach to the market trend is provided by market sentiment, which is based on the attitude and opinions of traders. Below you can read about each analysis method in detail.

Forex Technical Analysis Strategies

Technical Analysis Strategy

Technical analysis is the most useful tool a trader can rely on. It helps predict price movements by examining historical data - what is most likely to happen based on past information. Though, the vast majority of investors use both technical and fundamental analysis to make decisions. But before we start, if you are new to Forex trading, it is best to start with the basics, “What is Forex trading”.

Before diving into the technical analysis strategies, there is one more thing traders usually do - there are generally two different ways to approach technical analysis: the top-down approach and the bottom-up. Basically the top-down approach is first a macroeconomic analysis and then a focus on individual securities. The bottom-up approach focuses on individual stocks rather than a macroeconomic perspective.

Forex Technical Analysis Strategies

The first most important strategy to keep in mind when choosing a Forex technical analysis strategy - following one single system all the time is not enough for a successful trade.

- Forex Trend Trading Strategy - Like in any other field trend is the direction in which the market moves. The foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows.

- Forex Range Trading Strategy - is usually associated with a lack of market direction and is used when there is no trend, it could be implemented at any time, but the strategy, again, is most useful in cases where

market is lacking direction. Also there are different types of ranges that stand behind the strategy, here they are:

- Rectangular Range - the price of a security is trading within a bounded range where the levels of resistance and support are parallel to each other, resembling the shape of a rectangle. This model has pros and cons: Pros - rectangular ranges indicate a period of consolidation and tend to have shorter time frames than other range types, which can lead to faster trading opportunities. Cons - these ranges can be confusing for traders who are not looking for long-term patterns that can influence the formation of the rectangle.

Diagonal Range - the price descends or ascends via a sloping trend channel, this channel can be rectangular, broadening, or narrowing. This model has pros and cons as well:

Pros - with diagonal ranges, breakouts tend to happen on the opposite side of the trending movement, which gives traders an edge in anticipating breakouts and earning a profit.

Cons - although many diagonal range breakouts take place relatively quickly, some can take months or years to develop, which makes it tough for traders to make decisions based on when they expect a breakout to occur.

- Continuation Ranges - is a graphical pattern that unfolds within a trend. Pros - continuation ranges can occur frequently in the middle of ongoing trends, and they often result in a quick breakout, which bring profit quickly. Cons - because continuation patterns take place within other trends, there is added complexity to evaluating these trades, it makes continuation ranges a little tricky, especially for novice traders.

- Irregular Ranges - In an irregular range, determining support and resistance areas can be difficult, but possible. Pros - irregular ranges can be a great trading opportunity for traders capable of identifying the lines of resistance making up these ranges. Cons - the complexity of irregular ranges often requires traders to use additional analysis tools to identify these ranges and potential breakouts.

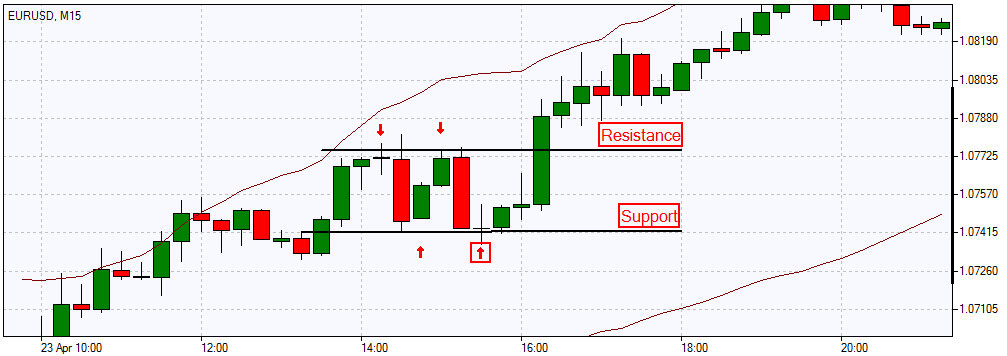

Support and Resistance Trading Strategy Guide - Support and resistance refers to price point beyond which stock does not have tendency to fall or rise. Levels are used to determine which direction to trade and at which price level traders should enter or exit positions. In order to grasp the core of the support and resistance trading strategy, traders should understand what a horizontal level is.

- Support levels - represents the lowest price that has stock tends to trade at.

- Resistance level - represents the highest price that has stock tends to trade at.

These terms are used to refer to price levels on charts that tend to act as barriers, preventing the price of an asset from getting pushed in a certain direction. Support line formation is subjected to laws of supply and demand - when stock price drops demand increases, thus support line forms, same happens with resistance line only viceversa.

When the zone of support or resistance is identified, those price levels can serve as potential entry or exit points because, as a price reaches a point of support or resistance, it will do one of two things—bounce back away from the support or resistance level, or violate the price level and continue in its direction—until it hits the next support or resistance level.

Forex Charts Trading Strategies - are developed on chart patterns analysis. Charts analysis give traders opportunity to look at the historical data and see price movements tendencies overall, spot same patterns overtime etc. Depending on what information trader is looking for and has on hands he/she can choose the most convenient chart for the analysis.

There are certain types of charts: the bar chart, the line chart, the candlestick chart and the point and figure chart. By using the following technical Forex patterns traders are able to make more precise trading decisions:

Continuation Patterns - price pattern that denotes a temporary interruption of an existing trend.

- Pennants - key characteristic of pennants is that the trendlines move in two directions — one will be a down trendline and the other an up trendline. The two trendlines do eventually come together and that represents a signal to trade.

- Flags - constructed from two parallel trend lines that can slope up, down or sideways - a flag that has an upward slope appears as a pause in a down, a flag with a downward bias shows a break during an up trending market.

Wedges - are using two converging trend lines - a wedge is characterized by two trend lines moving in the same direction, either up or down.

A wedge that is angled down represents a pause during an uptrend, a wedge that is angled up shows a temporary interruption during a falling market. During the formation of the pattern volume typically narrows with the purpose to increase once price breaks above or below the wedge pattern.

Triangles - are the most popular chart patterns among others used in technical analysis since they occur more frequently in comparison to other patterns.

There are 3 most common types of triangles - symmetrical triangles (occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—not the direction), ascending triangles (characterized by a flat upper trend line and a rising lower trend line and suggest a breakout higher is likely), and descending triangles ( have a flat lower trend line and a descending upper trend line that suggests a breakdown is likely to occur). These chart patterns can last from a couple of weeks to several months.

- Cup and Handles - is a bullish continuation pattern where an upward trend has paused, but will continue when the pattern is established. First comes "V" shape with equal highs on both sides of the cup, then the "handle" in a more settled trend - flatter and restrained pattern with slower increase.

- Reversal Patterns - price pattern that signals a change in the prevailing trend is known as a reversal pattern.

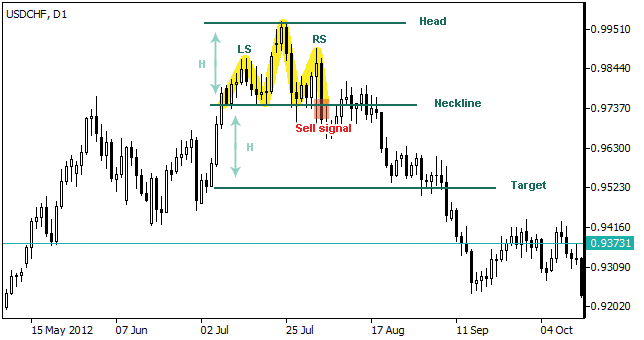

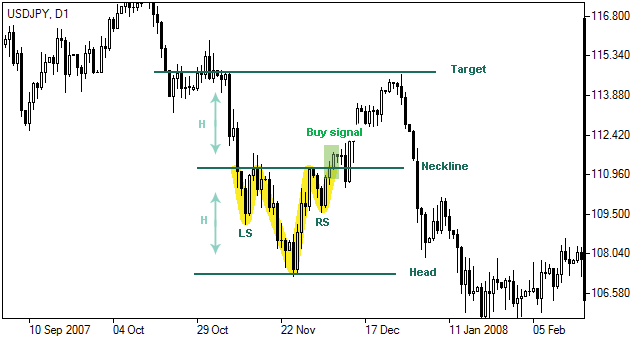

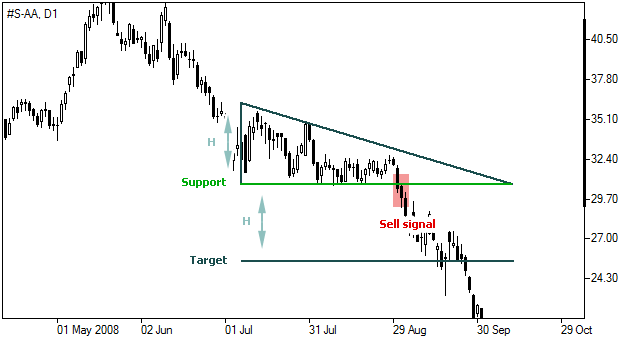

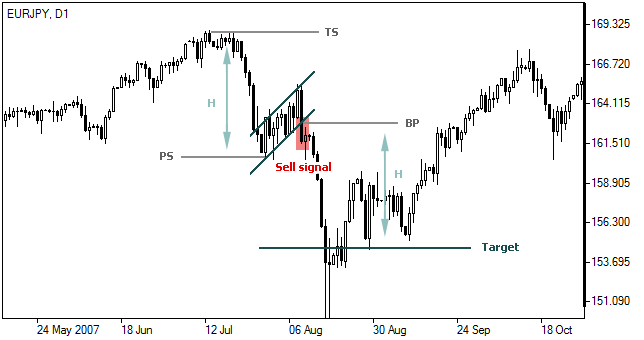

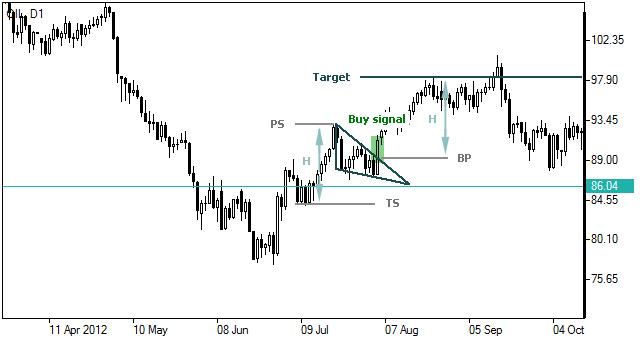

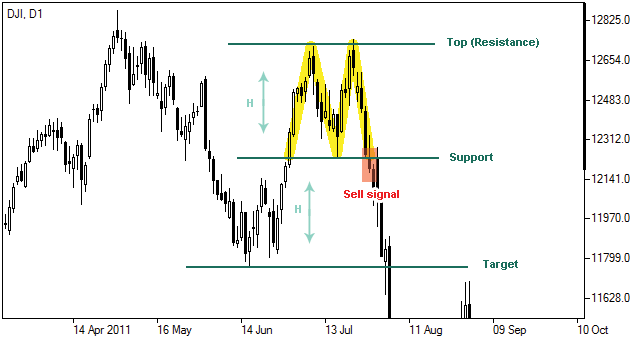

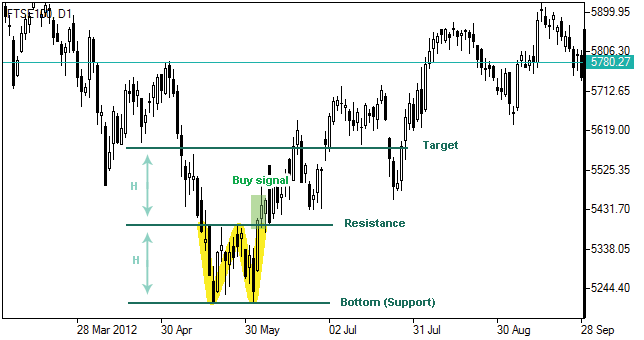

- Head and Shoulders - patterns can appear at market tops or bottoms as a series of three pushes: an initial peak followed by a second and larger one and then a third push that mimics the first.

- Double Top - where the market has made two unsuccessful attempts to break through a support or resistance level. Acts in a similar fashion as double bottom and can be a powerful trading signal for a trend reversal. The patterns are formed when a price tests the same support or resistance level three times and is unable to break through.

- Gaps - occur when there is empty space between two trading periods that’s caused by a significant increase or decrease in price.

Forex Volume Trading Strategy - Volume Trading is the number of securities traded for a certain time. The higher the volume, the higher the degree of pressure, which, depending on number of nuances, can indicate the beginning of a trend. Volume analysis can help understand the strength in the rise and fall of individual stocks and markets in general.

To determine that, traders should look at the trading volume bars, presented at the bottom of the chart. Any price movement is more significant if accompanied by a relatively high volume + a weak volume. Not all volume types may influence the trade, it’s the volume of large amounts of money that is traded within the same day and greatly affects the market.

There are a few general steps to take, before making trading decisions.

- Trend Confirmation - traders need increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Increasing price and decreasing volume might suggest a lack of interest, this might be a warning of a potential reversal. A price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed.

- Exhaustion Moves and Volume - in a rising or falling market, we see movement exhaustion typically, sharp price movements, combined with a sharp increase in volume, signal the potential end of the trend.

- Bullish Signs - Volume can be useful for spotting bullish signs. For example, volume increases when the price falls, and then the price moves up and then down again. If the price does not fall below the previous low when it moves back, and volume decreases during the second decline, then this is usually interpreted as a bullish sign.

- Volume and Price Reversals - If, after a prolonged price move higher or lower, the price begins to fluctuate with little price movement and large volume, this may indicate a reversal and prices will change direction.

- Volume and Breakouts vs. False Breakouts - On the initial breakout from a range or other chart pattern, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout speaks of lack of interest - higher probability for a false breakout.

- Volume History - Volume should be looked at relative to recent history. Comparing today's volume to 50 years ago might provide irrelevant data. The more recent the data sets, the more relevant results are likely to be.

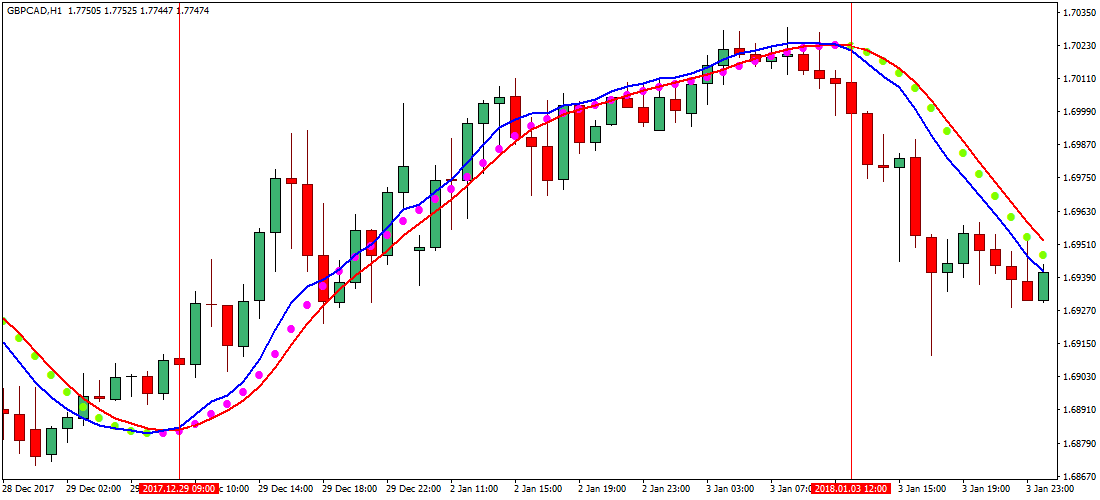

- Multiple Time Frame Analysis Strategy - analysing security's price during different time frames and detecting "trading circles", in other words discovering repetitive patterns and taking advantage of it. It could be done either on smaller or bigger timeframes scales.The process starts from exact determination of market direction on longer timeframes, then drilling down to shorter - f.e. 5-minute charts.

- Technical Indicators in Forex Trading Strategies - are based on patterns signals formed by price, volume and open interest of a securities. Technical analysis is trading that helps to evaluate investments and

identify trading opportunities by analyzing statistical trends gathered from trading activity. There are two basic types of technical indicators.

-

Overlays (are applied over the prices on the exchange chart)

- Moving Average - the reason for calculating the moving average of a stock is to help smooth out the price data by creating a constantly updated average price. Random, short-term fluctuations on the price of a stock over a specified time-frame are soften.

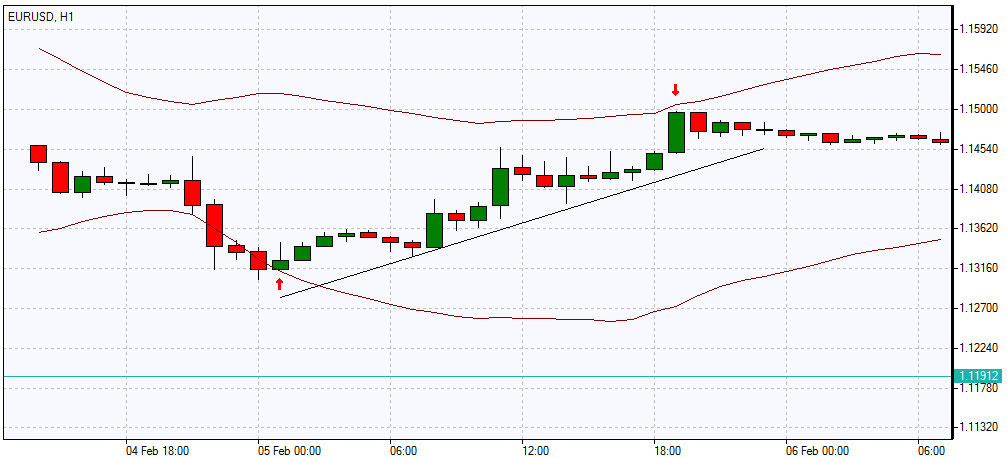

- Bollinger Bands - tool defined by a set of trend lines, applied two standard deviations (positively and negatively) away from a simple moving average (SMA) of a security's price. It gives investors a higher probability of properly identifying when an asset is oversold or overbought.

-

Oscillators (are applied above or below a price chart)

- Stochastic Oscillator - is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time. Stochastic Oscillator is used to generate overbought and oversold trading signals, utilizing a 0–100 bounded range of values. The general idea is that in a market trending upward, prices will close near the high, and in a market trending downward, prices close near the low.

- Moving Average Convergence/Divergence (MACD) - is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. MACD indicator triggers technical signals when it crosses above (to buy) or below (to sell) its signal line. It helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening.

- Relative Strength Index (RSI) - is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to assess overbought or oversold conditions in the price of a stock or other asset. RSI indicator is displayed as an oscillator, a line chart that moves between two extremes and can range from 0 to 100.

-

Overlays (are applied over the prices on the exchange chart)

PRACTICE MAKES PERFECT

Technical Trading Strategies

The idea behind technical trading strategies is to find a strong trend followed by price rollback. Rollback should last for a short period of time, as soon as price retracement pauses trend will resume and continue moving in the direction of prevalent trend.

Technical analysis trading is useful for any type of market from stock trading, Forex trading and, even cryptocurrency trading. For example, an investor could use technical analysis on a stock like (S-GOOG) Alphabet Inc. - get a report to decide if it is a buy or not in 2021. The chart could show Alphabet's price and trading volume.

Forex Trend Trading Strategy

What is Trend Trading

A trend is nothing more than a tendency, a direction of market movement, i.e. one of the most essential concepts in technical analysis. All the technical analysis tools that an analyst uses have a single purpose: to help identify the market trend.

The meaning of the Forex trend is not so much different from its general meaning - it is nothing more than the direction in which the market moves. But more precisely, the foreign exchange market does not move in a straight line, its moves are characterized by a series of zigzags that resemble successive waves with clear peaks and troughs or highs and lows, as they are often called.

Trend trading is considered a classic trading strategy, as it was one of the first of them, and takes its rightful place today. We believe that trend trading will remain relevant among traders around the world in the future. All thanks to three main, but simple principles:

- Buy, when the market goes up, i.e. we are seeing an uptrend/bullish trend

- Sell, when the market goes down, i.e. we are seeing a downtrend/bearish trend

- Wait and take no action when the market moves neither up nor down, but horizontally, i.e. we are seeing a sideways trend/consolidation

Sideways trend

Trend Following Strategy

The trend following strategy can be applied to trade on a wide variety of timeframes, but the most accurate forecasts and lower risks relate to medium and long-term trading, where stronger and long-lasting trends are observed. Trend trading can be the best choice for swing traders, position traders, i.e. those who see and predict the direction of the market movement in the future. However, both scalpers and day traders also catch trends, but less strong and very short-lived, a sort of fluctuations within the main trend.

Any trader, regardless of their trading method, must, first of all, use technical analysis to determine the current trend in the market of a traded asset and try to predict its further development, using technical analysis.

The technical analysis tools applied are usually extremely simple and user-friendly, each trader can select a variety of indicators, lines, time frames, etc., based on the characteristics of the asset they invest in, their individual

preferences, and other factors. However, the most commonly used ones are moving averages of different periods:

Bollinger bands, the Williams Alligator, Ichimoku cloud, Keltner

channels, MACD, and ADX indicators, as well as various advanced modifications of classic indicators.

Since the indicators are inherently lagging, i.e. reflect the impact of past events and market movements, it is also important to use oscillators to predict the development of the trend and identify the entry points, set stop loss, take profit, trailing stop orders correctly.

Here are three main techniques for entering the market:

- Classic (i.e., entering the market at the intersection of two moving averages)

- At a breakout (i.e., placing a pending order and entering the market after confirming the price intention to continue the trend)

- At a retreat (i.e., entering the market not immediately by a trading signal, but later, when the price is at a more favorable level)

Breakout and classic techniques have some similarities, for example, in both cases, the absence of a take profit order and the setting of a trailing stop would be a rational decision. Entering the market at a retreat is riskier since there is no guarantee the trend will continue as intended rather than reverse.

Before going back to the types of trends in Forex, you should know "What is Forex Trading". If you're good let's continue to the types of trends in Forex. According to the theory of supply and demand, the market has 4 main phases of development:

- Accumulation (sideways movement, consolidation).

- Markup (bullish trend/uptrend).

- Distribution (sideways movement, consolidation).

- Markdown (bearish trend/downtrend).

In fact, on a two-dimensional chart, the trend can move up (phase №2), down (phase №4), or remain relatively horizontal (phases №1 and №3). Let's go through each of the types of trends in Forex separately.

An uptrend, or bullish trend, is a movement in the price of an asset when the lows and highs progressively increase, i.e. every next maximum/minimum is higher than the previous maximum/minimum. In fact, the bullish trend identifies growth in price in a specific timeframe.

As a rule, traders begin to actively buy exactly on the ascent of the trend line, but often they open positions when the bullish bias reaches its peak and flows into the phase of distribution, in which the price moves horizontally and prepares for the final phase of the bullish trend.

Bullish trend

However, non-professional traders hold their positions longer than necessary at the end of an uptrend, hoping for the trend to continue, and often move into drawdown and lose their investments. More experienced traders manage to correctly detect the end of the 1st market phase, i.e. just before the price advances, and open long positions.

Short positions are opened either during the distribution phase or at the very beginning of the 4th phase when the trend reverses. The current bullish trend can be detected by drawing the support line at the low

points:

the price bounces up at the lows as if pushing off the support line, thereby increasing the highs. If the support line vector on the chart is pointing up, then this is definitely an uptrend.

A downtrend, or bearish trend is a movement in the price of an asset when the lows and highs consistently decrease, every next maximum/minimum is lower than the previous maximum/minimum. In fact, the bearish trend identifies a fall in price in a particular timeframe. The downtrend goes through the same phases and in the same sequence as an uptrend: accumulation of positions, stabilization of the trend, distribution (consolidation).

Bearish trend

However, if traders go long during the uptrend, then the downtrend implies the opening of short positions, and it is important to set sell orders (including pending orders) within the distribution phase at the desired price.

In a downtrend, the trend line (in this case, the resistance line) is drawn along the tops:

the price, as if meeting resistance, repels and tends downward, then, with a slight correction, rises back to the support

line and bounces off. If the resistance line vector on the chart is directed downward, then this is definitely a downtrend.

There is an expression popular among traders: “Trend is your friend” which applies to both the uptrend and the downtrend. However, we can observe an apparent trend only 20-30% of the time, the rest of the time the market is relatively neutral and remains flat, i.e.the price is traded in a narrow range, shifting between resistance and support lines.

A sideways trend, or consolidation, occurs when the potential of bears and bulls becomes equal, this often happens before the release of important macroeconomic and other news, since traders do not know exactly how this news will affect the movement of the asset’s price. That is why the sideways trend acts as the first and third market phases when positions are accumulated and distributed.

Also, sideways movement occurs due to the lack of players in the market between trading sessions or during trading of any asset at an atypical time for it. Trading in a sideways trend is possible, but extremely risky. Such a movement will work more for scalpers who make money precisely from small and frequent fluctuations within predictable limits.

Let's sum up the above with a few remarks:

- The Trend is your friend, definitely. But you shouldn’t trade without taking into account the main principles of money and risk management and in the absence of a well-thought-out strategy.

- Forex trend trading is inherently simple, but this doesn’t mean it is inefficient. The complexity of trading strategies would only hinder the trader.

- At least 2 timeframes are required to identify the trend more reliably.

-

You can visually understand the direction of the trend as follows:

the price from the lower-left corner rises to the upper right corner - a bullish trend;

the price from the upper left corner falls to the lower right corner - a bearish trend;

the price moves flat and horizontally - a sideways trend. - The market moves horizontally about 70% of the time, but trading with such a movement is not worth it unless you have experience and a clear understanding of the market behavior during the accumulation and distribution phases.

- The more often the price meets the resistance/support line and, repelling, keeps the movement vector, the stronger and more stable the trend.

- If the price goes up/down sharply and steeply, the trend is more likely to reverse. If the trend is flatter, evenly rising/falling, then there is a high probability that it will last long.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Support and Resistance Trading Strategy

Support and Resistance lines

Among the fundamental and most commonly used technical analysis tools, support and resistance (SR) levels have a special place. Moreover, strategies based on them are used not only by beginners, but also by quite experienced traders, who have many other tools at their disposal, as well as extensive trading experience. So why have these simple lines become so widely used by investors? Let's think about this together, but before that we may need to strengthen the knowledge of What is Forex trading and how does it work.

SR levels

SR levels are conditional areas that each trader allocates individually by the price extremes - minimums and maximums, on a certain timeframe. These areas are often represented as lines, however, to calculate all the risks and correctly place orders, it is still better to depict the SR as areas on the chart.

It should be known that support and resistance lines on different timeframes will be drawn in completely different ways. It's worthy to note that SR lines on large timeframes, such as H1, H4, D1 and larger, are more reliable and less likely to be broken through, the same cannot be said for the SR lines drawn on M1, M5 or M15. There are no specific rules about whether to draw levels by candlestick bodies or by their shadows: experts have not yet agreed on this issue. Learn more about How to draw support and resistance.

Reasons for the formation of Support and Resistance Areas

To understand how Support & Resistance levels are formed and how to use them, we need to analyze the psychological component of this phenomenon. A market trend formation depends on the prevalence of one of three conditional groups in the market:

- Bears (open sell positions)

- Bulls (open buy positions)

- Undecideds (not yet on the market)

Imagine a situation with the price fluctuating in a consolidation area near the support line. Bears sell assets, bulls actively buy, and then the price begins to rise. In such a situation, the bears regret going short, and as soon as the price returns to the support line, they will close their orders to have a chance to break even.

The bulls are happy with this scenario, since their positions get profitable when the price rises, and at the very first correction of the price to the support line, they will go long again, as they believe the price will bounce off the support level one more time. Those traders who haven’t yet opened orders see that the sideways trend has turned upward and consider the moment of price correction and its rebound from the support level the most favorable for placing buy orders.

Thus, we see a clear BUY sentiment among traders at the very first, even slight price movement towards the support line. And when this happens, a huge number of market participants immediately go long, i.e. demand surges sharply, and supply does not keep pace with it, so the price rises as expected. The situation is reversed in the case of the resistance line, where supply rises steeply and demand slips downwards.

With such a common example, we can see a direct relationship between the Supply/Demand ratio and the Support/Resistance levels vector. This is why Support/Resistance lines are often called Supply/Demand levels.

How to trade using support and resistance levels?

We have sorted out the reasons how the S/R areas form. Now let's look at trading strategies based on support and resistance levels. When on the chart the price approaches the support or resistance line, it is expected to either bounce off that line or break it.

So, traders distinguish 3 types of trading based on the Support/Resistance levels: trading based on a rebound from levels (range trading), trading based on a level breakout, and a mixed type of trading (allows you to use both strategies alternately, depending on the current market situation). Let’s consider the two key strategies:

Range Trading

From the example above, it can be seen that with a significant accumulation of bullish potential, as the price approaches the support line, it is more likely that the price will reverse from the level. Then you can go long, placing the stop loss below the support level.

When the price moves towards the resistance line, and bearish sentiments prevail in the market, traders begin to actively open sell orders, as soon as the price reaches the Resistance level. As a result, the price bounces off the level and goes down.

In this case, the stop loss is usually placed above the resistance level. Using a take profit order and trailing stop mode also reduces the risk of losses and helps to fix profits in time. A rebound from levels occurs most often within consolidation (actually, the market is in this phase about 70% of the time), since the price alternately bounces from one level to another, so such trading is quite attractive for scalpers and short-term traders: insignificant profit per trade is compensated by the frequency of orders.

Breakout Trading

With large volumes in the market and a strong trend movement, the price may break through the support or resistance line, instead of reversing from it. Trend traders benefit the most from this price behavior.

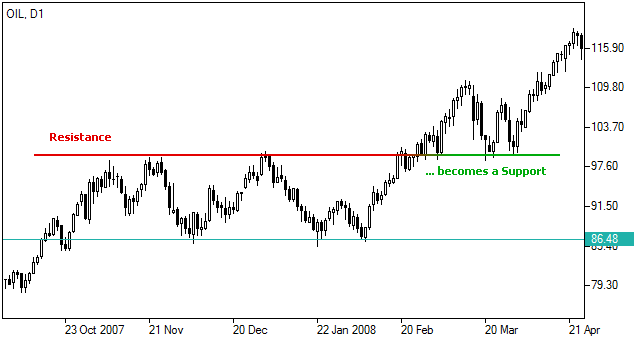

- If the price breaks the resistance level from the bottom up, then returns to this level during correction, the price is not always able to punch it from the other side, so it bounces up from the level, forming an upward trend. Thus, after the breakout the resistance line turns into a support line.

- If the price breaks through the support line from top down, and upon returning to this line, the price isn’t always able to break it from the opposite side now, so it ricochets off the level and continues its downward movement, becoming a downtrend. In this case, the support line is transformed into a resistance line after the breakout.

- In some cases, after breaking through the support/resistance level once, the price crosses it back from the opposite side during the correction and returns to the previous price range. It's called a false breakout.

Key Takeaways of Support and Resistance Trading

- Trading based on support and resistance levels is suitable for all types of markets: currency, commodity, stock. Also, it is applicable to any timeframe.

- The principles of such trading are simple and straightforward.

- It is easy to identify support and resistance zones with the help of moving averages and trend lines on any timeframe. They often act as Support/Resistance levels themselves.

- Levels are a universal tool for technical analysis. They are unbiased, since most traders are guided by them.

- The more often a level is tested, the stronger it is considered. However, you need to be extremely careful in order to timely notice changes in the trend and its possible reversal.

- Several false breakouts indicate the stability and strength of the level.

- Fibonacci levels, moving averages of at least two large periods with round numeric values, the Lines algorithm, the PZ and IchimokuSuppRes indicators, Pivot Points, Bollinger Bands, Fractals and many others can help identify the S/R areas.

In conclusion, it’s worth noting that the concepts of Support and Resistance levels are not new in trading; many investors are guided by them and build their strategies accordingly.

However, there are also those who believe that the levels based on old data may be useful in analyzing the market development in the past, but not in predicting the future movements, since there are no guarantees that the market will behave in one way or another, because there are plenty of factors influencing the market, and the behavior of millions of market participants is unpredictable.

PRACTICE MAKES PERFECT

Forex Range Trading Strategy

KEY TAKEAWAYS

- Range trading is a forex trading strategy that involves the identification of overbought and oversold currency.

- Range trading strategy is sometimes criticized for being too simplistic, but in actuality it never failed.

- Traders, should look at long-term patterns that may be influencing the development of a rectangle.

- The complexity of irregular ranges requires traders to use additional analysis tools to identify these ranges and potential breakouts.

Forex Range Trading Strategy

Traders generally look for the best trading strategy to help them profit. Before attempting range trading, traders should fully understand its risks and limitations. Range trading strategy is becoming increasingly popular lately. But before we start, if you are new to Forex trading, it is best to start with the basics, “What is Forex trading and how does it work”.

Range trading is a forex trading strategy that involves the identification of overbought and oversold currency, i.e buying during oversold/support periods and selling during overbought resistance periods. This type of strategy can be implemented nearly at any time, though it is preferable to use it when the market doesn’t have any distinguished direction, meaning is most effective when the Forex market has no discernible long-term trend in sight.

What is Range Trading

Range trading is an active investing strategy that identifies a range at which the investor buys and sells at over a short period. For example, a stock is trading at $55 and you believe it is going to rise to $65, then trade in a range between $55 and $65 over the next several weeks.

Traders might attempt to range trade it by purchasing the stock at $55, then selling if it rises to $65. Trader will repeat this process until he/she thinks the stock will no longer trade in this range.

Types of Range

To successfully trade while using Range trading strategy traders should know and understand the types of ranges. Here are the four most common types of range that you will find useful.

Rectangular Range - When using range trading strategy traders will see a rectangular range, there will be sideways and horizontal price movements between a lower support and upper resistance, it's common during most market conditions.

From the chart it is easy to see how the price movement of the currency pair stays within the support and resistance lines creating a rectangular (hence the name) range, from which traders clearly can see possible buy and sell opportunities.

Note: traders, should look at long-term patterns that may be influencing the development of a rectangle.

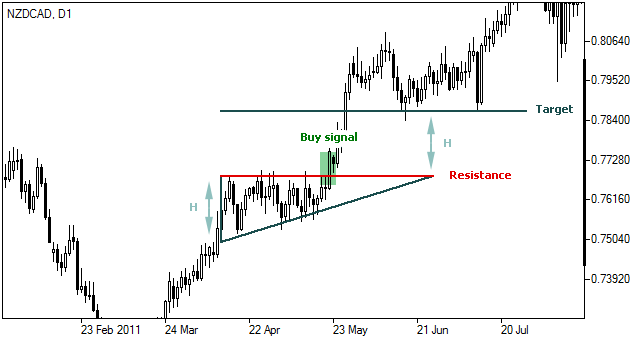

Diagonal Range is a common forex chart pattern. This type of range establishes upper and lower trendlines to help identify a possible breakout. In a diagonal range, the price descends or ascends via a sloping trend channel. This channel can be broadening, or narrowing.

Note: diagonal range breakouts take place relatively quickly, some can take months or years to develop, traders have to make decisions based on when they expect a breakout to occur, which can be hard.

Continuation Ranges is a graphical pattern that unfolds within a trend. These ranges occur as a correction against a predominant trend and can occur at any time as a bearish or bullish movement.

Note: continuation patterns take place within other trends, there is added complexity to evaluating these trades, especially for novice traders it is going to be hard to spot continuation ranges.

Irregular Ranges emerge differently from the previous three: trend take place around a central pivot line, and resistance and support lines crop up around it. That’s why it’s hard determining support and resistance lines. “Excellence" is not a gift, but a skill that takes practice, and applies to all Forex patterns.

Note: The complexity of irregular ranges requires traders to use additional analysis tools to identify these ranges and potential breakouts.

Bottom Line on Range Trading Strategy

Traders that choose to use Range trading strategy have to understand not only types of ranges, but the strategy lying behind using it.

Range trading strategy is sometimes criticized for being too simplistic, but in actuality it never failed. Traders need to identify the range, time their entry and control their risks of exposure and of course understand the fundamentals of hte strategy. Range trading can be quite profitable.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Technical Indicators Trading Strategy

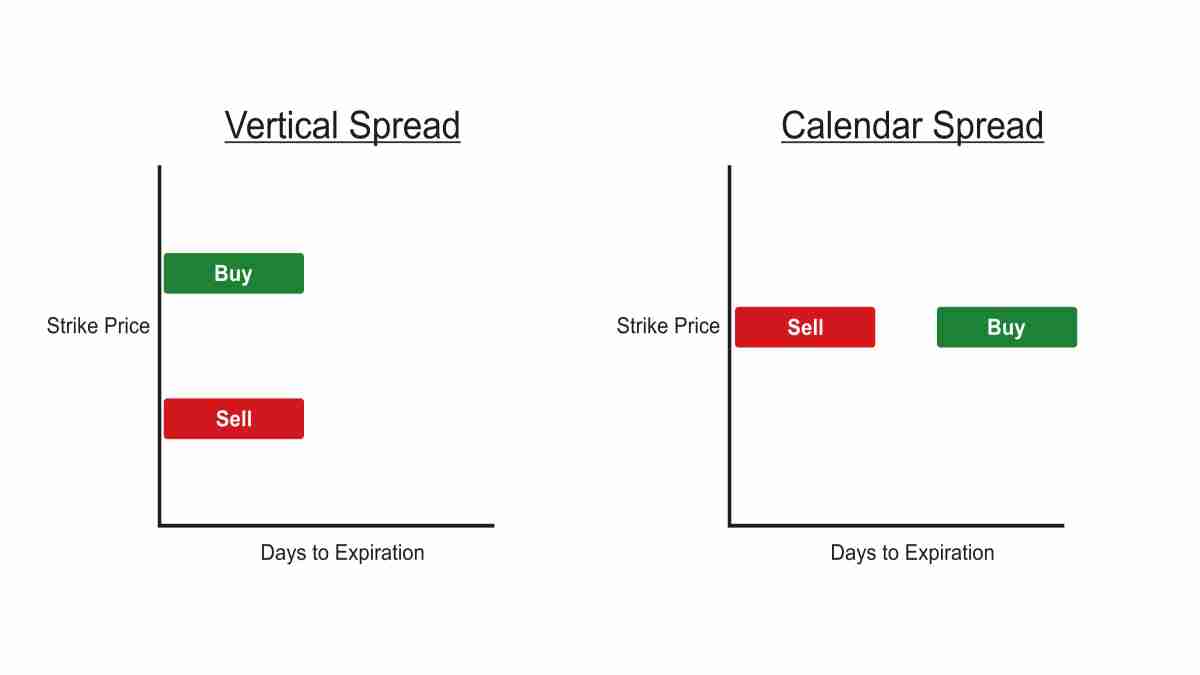

Trading strategies often use technical indicators to determine entry, exit or trade management rules and sometimes strategies use more than just one indicator which helps to identify the moment trades should occur.

From this article, you will learn that even though the indicators and trading strategies are different, they are both used in tandem by technical analysts to determine trading setups with high probability. But if you are new to Forex trading, you can read our other article "What is Forex trading" and then continue reading about the technical indicators strategy.

KEY TAKEAWAYS

- Technical indicators are used to see past trends to anticipate future moves.

- There are several technical indicators that can be divided into two main categories: Overlays and Oscillators.

- Frequently, one of the indicators is used to confirm the other indicator's accuracy.

- With a wide variety of indicators at hand, traders should choose the indicators that work best for them and become familiar with how they work.

Technical Indicators Trading Strategy

First let’s understand what technical indicators are.

Technical indicators are pattern-based signals produced by the price, volume, and open interest rates of a security. Technical analysis is trading that helps to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity.

When using indicators the goal is to identify trading opportunities. So the idea behind technical trading strategies is to find a strong trend followed by price rollback. Rollback should last for a short period of time, as soon as price retracement pauses trend will resume and continue moving in the direction of prevalent trend.

Traders when implementing strategies usually use trade filters and triggers which are most of the time based on indicators.

- Trade filters - when investing, a filter is used to narrow down the number of choices from a given set of securities.

- Тrade triggers - used to automate certain types of trades, such as the selling or buying shares when the price reaches a certain level.

For example Moving Average can be used to identify trade filters and trade triggers, like buying when price moves above the moving average and vice versa. Surely it doesn't stop there, there are a few more clarifications that need to be done, because a simple rule lacks definitive details for taking action, like - how far above the moving average does price need to move or What type of order will be used to place the trade. But now you get the idea, how indicators can be used in strategy.

An indicator stand alone is not a trading strategy. Indicators help understand the market, but a plan of implementation, so called rule book of investments and trading is strategy, where traders can use multiple technical indicators.

Main question for traders is to choose the right indicators for the strategy, since traders build their strategy based on the risk tolerance and preferences they have, indicators need to be chosen accordingly.

- A trader with long-term moves preferences and large profits might choose to focus on a trend-following strategy, therefore, will pick a moving average indicator as a stepping stone.

- A trader interested in short term transactions with frequent small gains might be inclined in a strategy based on volatility.

Note: Frequently, one of the indicators is used to confirm the other indicator's accuracy.

Technical Indicators Trading

- Overlays (are applied over the prices on the exchange chart)

- Moving Average - the reason for calculating the moving average of a stock is to help smooth out the price data by creating a constantly updated average price. Random, short-term fluctuations on the price of a stock over a specified time-frame are soften.

- Bollinger Bands - tool defined by a set of trend lines, applied two standard deviations (positively and negatively) away from a simple moving average (SMA) of a security's price. It gives investors a higher probability of properly identifying when an asset is oversold or overbought.

- Oscillators (are applied above or below a price chart)

- Stochastic Oscillator - is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time. It is used to generate overbought and oversold trading signals, utilizing a 0–100 bounded range of values. The general idea is that in a market trending upward, prices will close near the high, and in a market trending downward, prices close near the low.

- Moving Average Convergence/Divergence (MACD) - is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. MACD triggers technical signals when it crosses above (to buy) or below (to sell) its signal line. It helps investors understand whether the bullish or bearish movement in the price is strengthening or weakening.

- Relative Strength Index (RSI) - is a momentum indicator used in technical analysis that measures the magnitude of recent price changes to assess overbought or oversold conditions in the price of a stock or other asset. RSI is displayed as an oscillator, a line chart that moves between two extremes and can range from 0 to 100.

Bottom Line on Technical Indicators Trading Strategy

When analyzing a security, traders often use many different technical indicators. With a wide variety of indicators at hand, traders should choose the indicators that work best for them and become familiar with how they work. Traders can also combine technical indicators with more subjective forms of technical analysis, such as studying Forex chart patterns which will help to come up with trading ideas. Technical indicators can also be included into automated trading systems, given their quantitative nature.

In general, each trader should determine the correct method in which indicators will be used to signal trading opportunities and facilitate the development of a trading strategy.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Chart Pattern Trading Strategy - Chart Patterns in Forex

KEY TAKEAWAYS

- There are several trading methods, each of which uses price patterns to find entry points and stop levels

- One limitation shared across many technical patterns is that it can be unreliable in illiquid stocks

- Traders often use chart patterns as a Forex strategy.

Forex Chart Pattern Strategy

Traders often use chart patterns as a Forex strategy.

Forex market has a behavior that shows patterns. Chart patterns usually occur during change of trends or when trends start to form. There are known patterns like head and shoulder patterns, triangles patterns, engulfing patterns, and more. Let us introduce to you some of them, it will help you identify the trend of the market and trade accordingly.

Chart Patterns in Forex

There are several trading methods, each of which uses price patterns to find entry points and stop levels (you can read more about trading in our article " What is Forex trading and how does it work"). Forex charting patterns include head and shoulders as well as triangles, which provide entries, stops and profit targets in a form that can be easily seen.

Head and Shoulders (H&S) chart pattern is quite popular and easy-to-spot in technical analysis. Pattern shows a baseline with three peaks where the middle peak is the highest, slightly smaller peaks on either side of it. Traders use head and shoulders patterns to predict a bullish and bearish movement.

Head and shoulders shaping is distinctive, chart pattern provides important and easily visible levels - Left shoulder, Head, Right shoulder. Head and shoulders pattern can also be inverse and will look like this and the pattern is called Inverse Head and Shoulders.

- Triangles fall under continuation patterns category, there are three different types them:

- Ascending triangle - The ascending triangle pattern in an uptrend, easy to recognize but is also quite an easy entry or exit signal.

- Descending triangle - The Descending triangle is noticable fot its downtrends and is often thought of as a bearish signal.

- Symmetrical triangle - Symmetrical triangles, as continuation patterns developed in markets, are aimless in direction. The market seems apathetic in its direction. The supply and demand, therefore, seem to be one and the same.

At the start of its formation, the triangle is at its widest point, as the market continues to trade, the range of trading narrows and the point of the triangle is formed. Because the triangle narrows it means that both buy and sell sides interest is decreasing - the supply line diminishes to meet the demand.

Chart Patterns Trading

Chart patterns are widely used in trading while conducting technical analysis. Studying these patterns will be useful for building or using as a trading strategy.

Cup and Handle A cup and handle is a technical chart pattern that resembles a cup and handle where the cup is in the shape of a "u" and the handle has a slight downward drift. Looks like this:

It is worth paying attention to the following when detecting cup and handle patterns:

- Length: Generally, cups with longer and more "U" shaped bottoms provide a stronger signal. Avoid cups with sharp "V" bottoms.

- Depth: Ideally, the cup should not be overly deep. Avoid handles that are overly deep also, as handles should form in the top half of the cup pattern.

- Volume: Volume should decrease as prices decline and remain lower than average in the base of the bowl; it should then increase when the stock begins to make its move higher, back up to test the previous high.

Flag is a price pattern that moves in a shorter time frame against the prevailing price trend observed in a longer time frame on a price chart. Reminds the trader of the flag, hence the name. Flag patterns can be upward trending (bullish flag) or downward trending (bearish flag).

Note: Flag may seem similar to a wedge pattern or a triangle pattern, it is important to note that wedges are narrower than pennants or triangles.

- The preceding trend

- The consolidation channel

- The volume pattern

- A breakout

- A confirmation where price moves in the same direction as the breakout

- Wedges form as an asset’s price movements tighten between two sloping trend lines. There are two types of wedge: rising and falling.

- The converging trend lines;

- Pattern of declining volume as the price progresses through the pattern;

- Breakout from one of the trend lines.

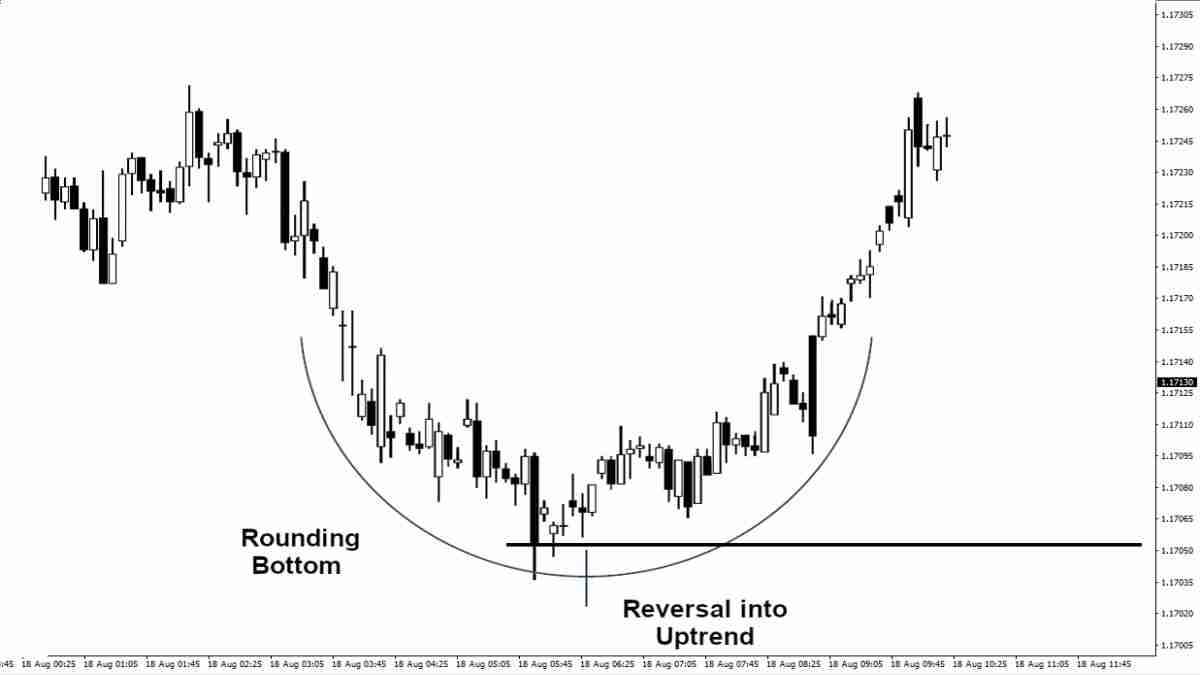

- Rounding bottom Chart pattern is identified by a series of price movements that graphically form the shape of a "U". Rounding bottoms are found at the end of long downward trends and signify a reversal in long-term price movements. It could take from several weeks to several months and it happens quite rarely.

- Double top is a bearish technical reversal pattern. Traders use double top to highlight trend reversals. Typically, an asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

Double bottom patterns are the opposite of double top patterns. Double bottom patterns if identified correctly are highly effective. Therefore, one must be extremely careful before jumping to conclusions.

The double bottom looks like the letter "W". The twice-touched low is considered a support level.

Flag patterns have five main characteristics:

Wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods, which ensures a good track record for forecasting price reversals. A wedge pattern can signal bullish or bearish price reversals. In either case, this pattern holds three common characteristics:

The two forms of the wedge pattern are a rising wedge, which signals a bearish reversal or a falling wedge, which signals a bullish reversal.

Bottom line on Chart Pattern Trading Strategy

All of the patterns are useful technical indicators which can help traders to understand how or why an asset’s price moved in a certain way – and which way it might move in the future. This is because chart patterns can highlight areas of support and resistance, the latest in turn can help a trader decide whether they should open a long or short position; or whether they should close their open positions in the event of a possible trend reversal.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Forex Volume Trading Strategy

KEY TAKEAWAYS

- Forex volume is the number of lots traded in a currency pair each day.

- Volume should be looked at relative to recent history.

- The higher the volume during a price move, the more significant the move and vice versa - the lower the volume during a price move, the less significant the move will be.

- When prices reach new highs or new lows and volume is decreasing, probably reversal is taking shape.

Forex Volume Trading Strategy

Volume Trading is the number of securities traded for a certain time. The higher the volume, the higher the degree of pressure, which, depending on number of nuances, can indicate the beginning of a trend. Volume analysis can help understand the strength in the rise and fall of individual stocks and markets in general.

To determine that, traders should look at the trading volume bars, presented at the bottom of the chart. Any price movement is more significant if accompanied by a relatively high volume + a weak volume. Not all volume types may influence the trade, it’s the volume of large amounts of money that is traded within the same day and greatly affects the market.

What is Forex Volume

Forex volume is probably one of the most important tools traders have at their disposal. Volume in Forex is based only on the individual pair on a given exchange at that point in time. That’s why it’s sometimes overlooked.

Forex volume is the number of lots traded in a currency pair each day. Volume is one of the most accurate ways of measuring money flow. Indicator tells traders about market activity and liquidity, that is, higher trading volumes mean higher liquidity. If you are new to Forex trading, it is best to start with the basics, “What is Forex”.

From the chart above, which is the GBP/USD, volume indicator, paints quite accurate even foreseeing the price picture. Using volume indicator traders can see whether the events, such as economic data publishing, breaking news have influenced the market.

Note: Volume overall tends to be higher near the market's opening and closing times and on Mondays and Fridays. It tends to be lower at lunchtime and before a holiday.

How to Trade with Volume

Volume shows how the market moves - the more volume, the easier it is to decide when to buy or sell (volume can’t tell the difference between bear and bull markets). Volume precedes price action, here are a few general steps to take, before making trading decisions.

1. Trend Confirmation

Traders need increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Increasing price and decreasing volume might suggest a lack of interest, this might be a warning of a potential reversal. A price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed.

2. Exhaustion Moves and Volume

In a rising or falling market, we see movement exhaustion typically, sharp price movements, combined with a sharp increase in volume, signal the potential end of the trend.

3. Bullish Signs

Volume can be useful for spotting bullish signs. For example, volume increases when the price falls, and then the price moves up and then down again. If the price does not fall below the previous low when it moves back, and volume decreases during the second decline, then this is usually interpreted as a bullish sign.

4. Volume and Price Reversals

If, after a prolonged price move higher or lower, the price begins to fluctuate with little price movement and large volume, this may indicate a reversal and prices will change direction.

5. Volume and Breakouts vs. False Breakouts

On the initial breakout from a range or other chart pattern, a rise in volume indicates strength in the move. Little change in volume or declining volume on a breakout speaks of lack of interest - higher probability for a false breakout.

6. Volume History

Volume should be looked at relative to recent history. Comparing today's volume to 50 years ago might provide irrelevant data. The more recent the data sets, the more relevant results are likely to be.

Bottom line on Volume Trading Strategy

Volume is a handy tool for studying trends, and there are many ways to use it. Basic guidelines can be used to gauge market strength or weakness, and to test whether volume confirms price movement or signals an impending reversal. Volume-based indicators are sometimes used to aid decision making.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Multiple Time Frame Analysis Strategy

KEY TAKEAWAYS

- Multiple time-frame analysis involves monitoring the same currency pair across different frequencies.

- Each time frame has its benefits.

- The methodology behind using multiple time frames is that traders can start to build a clearer picture of the price action and technical analysis story.

Multiple Time Frame Trading Strategy

Traders often use Forex patterns as a Forex strategy.

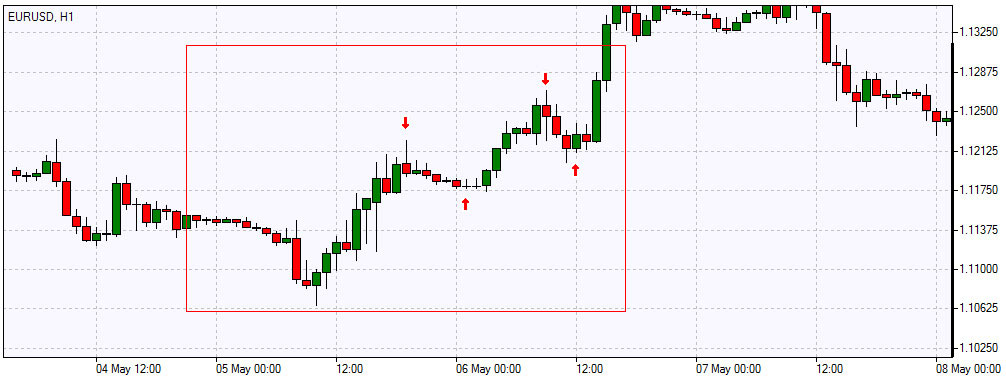

The multiple time frames trading strategy is a Forex trading strategy that works by following a single currency pair over different time frames. By following the price chart traders can see the highs and lows and establish the overall and temporary trend. However, when looking at the different time frames traders can see changes and patterns that they were not able to spot by using a single time frame.

Each time frame has its benefits. Long time frames allow traders to understand the bigger picture and identify the overall trend. Average time frames present the short term trend and show traders what is happening in the market right now. Short time frames are traders' way of recognizing the exact window for when to make their move.

Multiple Time Frame Analysis

Multiple time-frame analysis involves monitoring the same currency pair across different frequencies. There is no real limit on how many frequencies can be monitored, but there are general guidelines that most traders practice. So, generally traders use three different periods; enough to have a read on the market. If used more it might result in redundant information and if less could be not enough data.

It's important to choose the right time frames when selecting the range of three periods, for example, if a long-term trader who holds the position for months decides to pick a 15, 60 minute time frame combination it will probably tell nothing to the trader.

Long-Term Time Frame - When using this method of studying the charts, it is best done with a long-term time frame and work down to the more certain frequencies. When a trader starts with a long-term time frame, he/she will be able to establish a general and dominant trend.

In foreign exchange markets, where long-term time frames are daily, weekly or monthly, fundamental factors have a significant impact on the direction of movement. That's why traders should monitor the major economic trends when following the general trend on this time frame to better understand the direction in price action. Such dynamics, though, tend to change infrequently, so traders will only need to check those occasionally.

Another thing traders should look out for is the interest rate. This is a reflection of the health of the economy. In most cases, capital will flow towards the higher rate currency in the pair, as this equates to a higher return on investment.

Medium-Term Time Frame - most versatile of the three frequencies because it is at this level that traders can get an idea of the short and long term time frames. This level should be the most frequently followed chart when planning a trade while the trade is on and as the position nears either its profit target or stop loss.

Short-Term Time Frame - trades should be made on a short-term timeframe. As the smaller swings in the price action become clearer, the trader will be able to choose the best entry for a position already determined by the higher frequency charts.

In short-term time frames fundamentals play a role as well, but in a different way than they do for the higher time frame. The more detailed this lower time frame is, the stronger the reaction to economic indicators will seem. These jerky movements are often very short-lived and are therefore sometimes described as noise. However, the traders often avoid making these trades.

Trading Multiple Time Frames

When all three time frames are combined and analyzed properly in the correct order, it will increase the chances of success. Performing this three-tiered in-depth analysis encourages big trend trading. This alone reduces risk, as there is a higher likelihood that price action will eventually continue in the direction of a longer trend. Applying this theory, the level of confidence in a trade should be measured by how the time frame coincides.

For example, if the larger trend is uptrend (sorry for redundancy) but the medium- and short-term trends are heading lower, shorts should be taken with reasonable profit targets and stops. A trader should probably wait until a bearish wave runs out on the lower frequency charts and look to go long at a good level when the three time frames line up once again.

Using multiple time frames while analyzing trades it helps to identify support and resistance lines which in turn helps to find a strong entry and exit levels.

Multiple Time Frame Trading Methodology

Multiple Time Frame Trading Methodology is straightforward, traders only need to focus on three steps:

- Look at price action and structure: highs and lows, basically finding the trend.

- Draw Fibonacci retracement levels between highs and lows to find support and resistance levels.

- Enter trades in the direction of the trend at support and resistance when you get a buy or sell signal.

The methodology behind using multiple time frames is that traders can start to build a clearer picture of the price action and technical analysis story:

- First have to look at the long-term time frame, to establish the dominant trend

- Then increase the granularity of the same chart to the intermediate time frame: smaller moves within the broader trend become visible

- And at last, execute trades on the short-term time frame.

Bottom line on Multiple Time Frame Trading Strategy

Using multiple time-frame analysis can be instrumental in making a successful trade. From this article you should be able to take how important multiple time-frame analysis can be. It is a simple way to ensure that a position benefits from the direction of the underlying trend.

Fundamental Analysis Trading Strategy

KEY TAKEAWAYS

- Fundamental analysis goal is to calculate the fair market price of a security, which the trader can compare with the current price to see if the security is undervalued or overvalued.

- Fundamental analysis in forex includes economic conditions that may affect the national currency.

- There are several major indicators to monitor when conducting fundamental analysis.

Fundamental Analysis Strategy

Fundamental analysis is a method of measuring a security's value by analysing related economic and financial factors such as a country's macroeconomics, effectiveness of the company's management etc. Fundamental analysis strategy basically through this analysis trader studies anything that can influence security's value.

Fundamental analysis is used to identify if the security is correctly valued within the broader market, it's done from a macro and micro perspective. Analysis starts first from a macro perspective, only then moved to specific company’s performance (micro).

Data can be gathered from public records. A trader, when evaluating stock, should look for revenues, earnings, future growth, return on equity, profit margins etc..

If analysis shows that the stock's value is significantly lower than the current market price, then the signal is buy. And vice versa, if fundamental analysis shows the stock's value is significantly higher than the current market price, then the signal is sell.

Fundamental analysis strategy can be categorised in two groups:

- Quantitative - information that can be shown in numbers and amounts. They are the measurable characteristics of a business, like revenue, profit, assets, and more.

- Qualitative - the nature of information, rather than its quantity. They might include the quality of a company's key executives, its brand-name recognition, patents, and proprietary technology.

Usually quantitative and qualitative methods are used in the mix, when conducting fundamental analysis.

Fundamental Analysis Forex Strategy

Traders who trade in Forex also use fundamental analysis as well. Sinse fundamental analysis is about considering the intrinsic value of an investment, its application in forex will include considering economic conditions that may affect the national currency. But if you are new to Forex trading, you can start with another article "What is Forex trading" and then continue with the fundamental strategy.

Here are some of the major fundamental factors that play a role in the movement of a currency.

- Economic Indicators - Economic indicators are reports published by the government or a private organization that detail the economic performance of a country. Trader will find here unemployment rates and numbers, housing stats, inflation etc.

- GDP - is a measure of a country's economy, and it represents the total market value of all goods and services produced in a country during a given year.

- Retail Sales - measures the total revenue of all retail stores in a given country. The retail sales report can be compared to the trading performance of a publicly traded company. What can help trader better understand the market situation.

- Industrial Production - Traders usually look to utility production, which can be extremely volatile as the utility industry, in turn, is highly dependent on weather conditions and on trade and energy demand.

- Consumer Price Index - measures change in the prices of consumer goods across over 200 different categories, when compared to a nation's exports, can be used to see if a country is making or losing money on its products and services.

There are three main indicators to look closely when applying fundamental analysis strategies.

Purchasing Managers index (PMI) - is an index of the prevailing direction of economic trends in the manufacturing and service sectors. PMI is used to provide information about current and future business conditions to company decision makers, analysts, and investors.

MI is released once a month and contains 19 primary industries' companies surveys. PMI is based on five major survey areas, that contain questions about business conditions and changes, whether it be improving, no changes, or deteriorating.

- New Orders

- Inventory Levels

- Production

- Supplier Deliveries

- Employment

PMI number spreads from 0 to 100. when PMI is above 50, it represents an expansion when compared with the previous month. When PMI reading under 50, it represents a contraction, and when it's 50 - means no change.

Formula looks like this, quite simple:

PMI = (P1 * 1) + (P2 * 0.5) + (P3 * 0)Where:

P1 = percentage of answers reporting an improvement

P2 = percentage of answers reporting no change

P3 = percentage of answers reporting a deteriorationTraders can use the PMI since it is a leading indicator of economic conditions. The direction of the trend in the PMI tends to precede changes in the trend in major estimates of economic activity and output. Paying close attention to the PMI can yield profitable foresight into developing trends in the overall economy.

Producer Price index (PPI) - is a measure of inflation based on input costs to producers. It measures price movements from the seller's point of view.

There are three areas of PPI classification:

- Industry

- Commodity

- Commodity-based final and intermediate demand

PPI measure starts with number 100 and then and when the production increases or decreases, the movements can then be compared against the starting number (100).

F.e. production of ottoman has a PPI of 108 for the month of March. The 108 indicates that it cost the ottoman manufacturing industry 8% more to produce ottoman in March than it did in February.

Employment Cost index (ECI) - is a quarterly economic series that details the growth of total employee compensation. It tracks movement in the cost of labor, measured by wages and benefits, at all levels of a company.

The index has a base weighting of 100.

So the upward trend most of the time represents a strong and growing economy; employers are passing on profits to their employees through wages and benefits. Traders use this indicator for inflationary ideas, since wages represent a big portion of the total cost for a company to produce a product or deliver a service in the marketplace.

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.

Advantages and disadvantages of ECI

Advantages of ECI

- The ECI calculates the total set of employee costs to businesses, not just wages - health insurance, pensions and death-benefit plans, and bonuses.

- Rates of change are shown from the previous quarter and on a year-over-year basis.

Disadvantages of ECI

- The data is only released quarterly, and with a slight overlap, covering a mid-month period.

- ECI can be volatile when periodic bonuses, commission payments and the like are taken into account (especially at year-end - bigger bonuses).

Bottom Line on Fundamental Analysis Strategy

There are many economic indicators that can be used to evaluate forex fundamentals. It's important to take a thorough look not only at the numbers but also understand what they mean and how they affect a nation's economy. If the fundamental analysis is properly done, it can be an invaluable resource for any currency trader to make a somewhat right choice.

Sentiment Trading Strategy

KEY TAKEAWAYS

- Market sentiment reflects a market movement, based on traders' potential actions.

- Market sentiment is a third player along with fundamental and technical analysis in assessing market movement direction.

- Sentiment indicators are not exact buy and sell signals on their own, Trader has to wait for the price to confirm the reversal before acting on it.

Market Sentiment Definition

A market sentiment is an overall attitude and feeling of the investors with regards to the present price and the forecasted price of a security, index or other market instruments. Market sentiment is also called investor sentiment. It can be a positive, neutral or a negative one.

Market sentiment is important for technical analysis, since it influences the technical indicators and it is used by traders to navigate. Market sentiment is also used by opposing traders who like to trade in the opposite direction to prevailing consensus.

Investors describe market sentiment as bearish or bullish. When it's bearish - stock prices are going down. When bullish - stock prices are going up.

In these situations often time traders emotions drive the stock market and it might result in overbought or oversold cases. You can see, market sentiment driving force is feelings and emotions.

- Bullish Sentiment - in a bull market, the prices are expected to move in an upward direction. In this case greed is the moving force of the market.

- Bearish Sentiment - In a bear market, the prices are expected to move in a downward direction. In this case fear of losing money is the force.

Sentiment Trading Strategy

In Forex trading we have fundamental and technical analysis to assess currency pairs movement direction, but there is a third player that has a significant role in play, which is market sentiment. Sentiment indicator is another tool that can have an input for traders to extreme conditions and possible price reversals, and can be used in conjunction with technical and fundamental analysis. Before you continue reading about Sentiment Trading Strategy, you can strengthen your knowledge of forex trading by reading an article about "What is Forex trading and how does it work".

Market sentiment is a way of analysing Forex, stock and other markets' tendency to construct better trading strategies. These indicators show the percentage, or raw data, of how many trades or traders have taken a particular position in a currency pair.

These indicators show the percentage of how many trades or traders have taken a particular position in a currency pair. When the percentage of trades or traders in one position reaches maximum level, trader can assume that the currency pair continues to rise, and eventually, 90 of the 100 traders are long, hence there are very few traders left to keep pushing the trend up. Indication is for a price reversal.

As we mentioned earlier market sentiment is mostly created by emotions, which results in overvalued or undervalued stocks etc.. So some traders hunt those stocks and bet against them. To measure those markets traders use these indicators, not only to bet against, but to uncover the short-term trend:

- CBOE Volatility Index (VIX) - If traders feel the need to protect against risk, it's a sign of increasing volatility adding moving averages and the trader would be able to determine if it's relatively high or low.

- High-Low Index - When the index is below 30 - stock prices are trading near their lows, hence bearish market sentiment. When the index is above 70, stock prices are trading toward their highs, hence bullish market sentiment.