- Education

- Forex Technical Analysis

- Technical Indicators

- Bill Williams Indicators

- Bill Williams Alligator

Bill Williams Alligator - Alligator Indicator Formula

What is Alligator Indicator

Bill Williams introduced the Alligator indicator almost three decades ago in 1995. But it is still a very popular indicator in trading circles.

It consists of three lines, overlaid on a pricing chart, that represent the jaw, the teeth and the lips (or something resembling lips) of the beast. This indicator was created to help traders to confirm the presence of a trend and its direction. Our traders may also need another article about "What is Forex trading and how does it work".

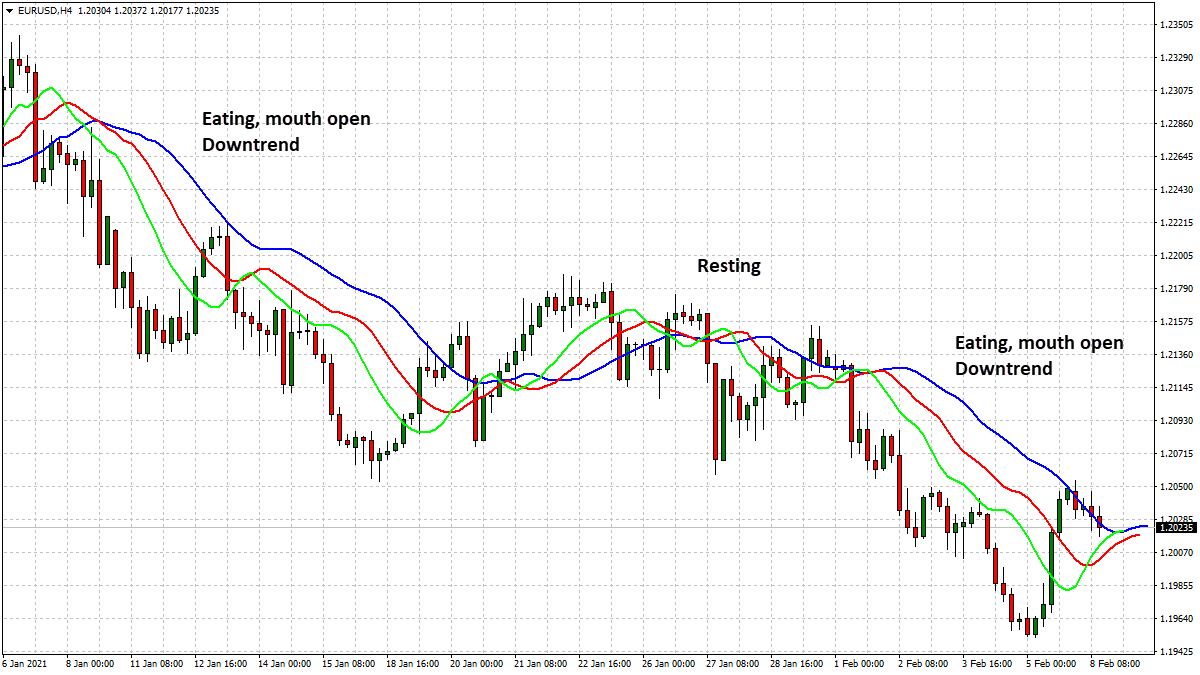

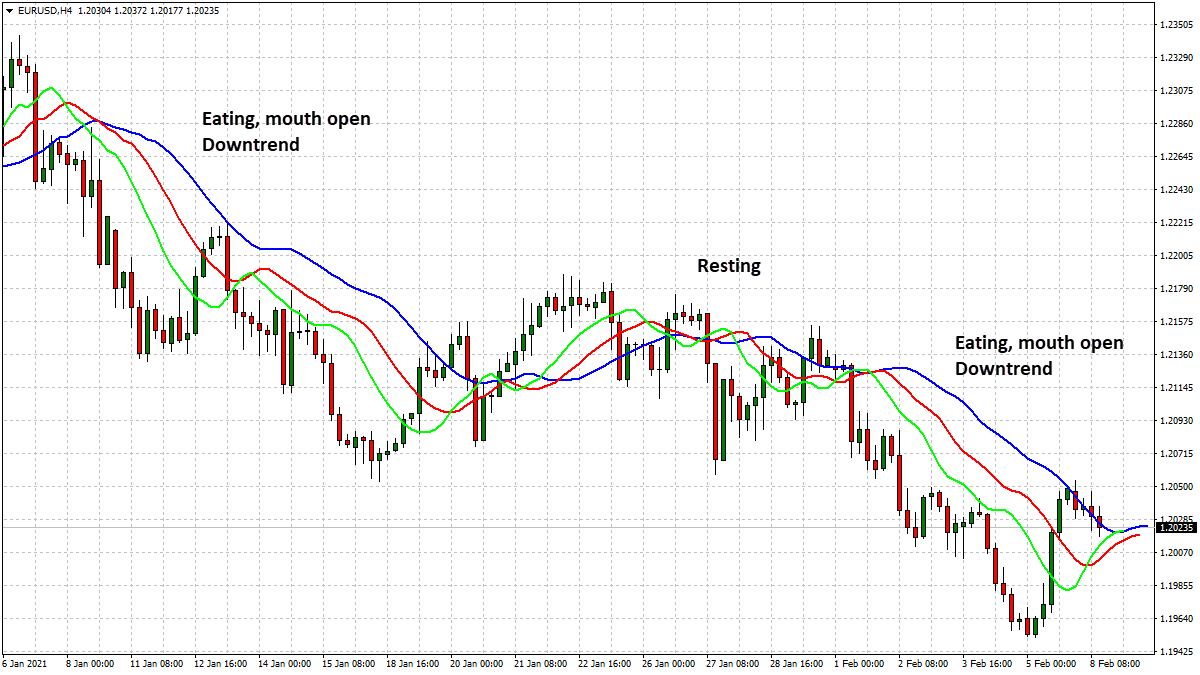

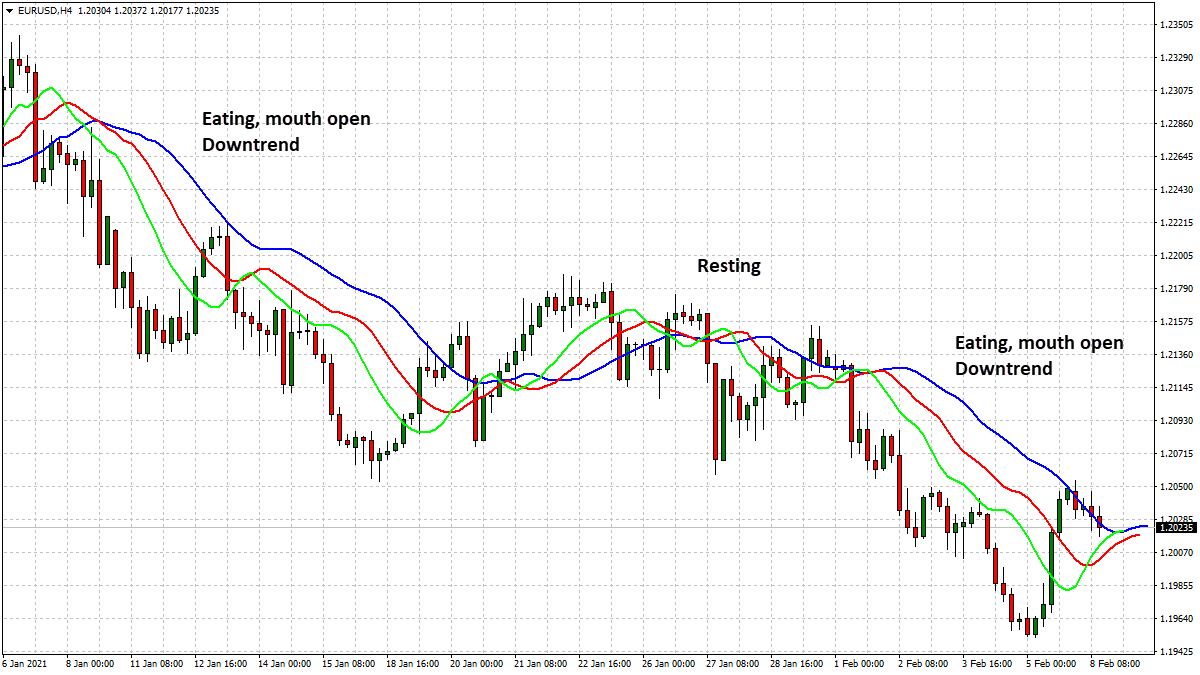

Check out the Alligator indicator on the price chart.

KEY TAKEAWAYS

- Alligator indicator is a technical analysis tool that uses smoothed moving averages.

- The calculation of the Alligator indicator is terrifying at first glance and at second too.

- When the mouth opens, it signals that you should enter a trade.

Table of Content

- What is Alligator Indicator

- How to Use Alligator Indicator

- Alligator Indicator Formula (Calculation)

- Bill Williams 3 Lines

- Some key points about the Alligator Indicator

- Alligator Indicator Strategy

- Bottom line on Alligator Indicator

Bill Williams invented many indicators and gave them unique and catchy names, such as Awesome Oscillator, Gator Indicator, Alligator Indicator.

How to Use Alligator Indicator

When trading with the use of Alligator indicator, traders should start looking at thee key pieces of information, traders can use them as part of their trading strategy, let's take a look;

Sleeping Alligator

When the green, red and blue lines are very close to each other or intertwined, traders can make a conclusion that the market lacks trend;

Awakening Alligator

When the red and blue moving averages are heading in the same direction, the green moving average passes through them, and all three end up going in the same direction, suggests to trader that trend is about to formate;

Hungry Alligator

Is when the green line is above the red line and the red line is above the blue line, there is an uptrend, and when the order of the lines is reversed (blue top, red middle, green bottom), the market is in a downtrend. When the lines expand, it confirms the trend. All this can tell traders about the direction of the trend.

Alligator Indicator Formula (Calculation)

The calculation of the Alligator indicator is terrifying at first glance, yet here we go

Calculation of the Alligator Indicator

SMA:

- SUM1 = SUM (CLOSE, N)

- SMMA1 = SUM1/N

- Subsequent values are:

- PREVSUM = SMMA(i-1) *N

- SMMA(i) = (PREVSUM-SMMA(i-1)+CLOSE(i))/N

Where

SUM1 - the sum of closing prices for N periods;

PREVSUM - smoothed sum of the previous bar;

SMMA1 - smoothed moving average of the first bar;

SMMA(i) - smoothed moving average of the current bar (except for the first one);

CLOSE(i) - current closing price;

N - the smoothing period.

Still horrified?

Well, lucky us, the calculation is not required in practice. The Alligator indicator can be added to your charts from the indicator list in your charting.

You can try to start trading using Alligator indicator with us, for example if a downtrend is about to hit the market you can open a ‘sell’ position (go short ), and if you think that the alligator indicator is signaling an uptrend, you can open a buy position (open a long position).

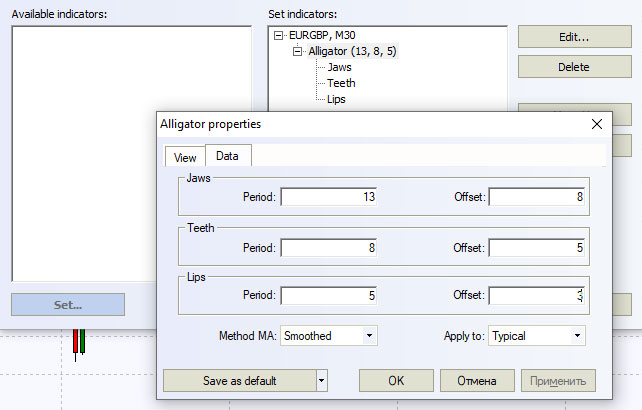

Bill Williams 3 Lines

The Alligator Forex indicator consists of three moving averages called jaws, teeth and lips. Each of them has its own color and is responsible for a certain stage in the development of the market. Of course, everyone has their own weight and strength.

- The green line indicates the lips - this level is the weakest and has the fastest reaction to price changes. It's used to summarize open positions in a trend if there is a strong momentum on the chart. The lip line is a smoothed moving average (SMA) with a default period of 5, shifted 4 bars into the future. This moving average is the first to react to changes in the balance of power of buyers and sellers in the market.

- The red line indicates the teeth - the line is the average support/resistance level of the strength. It serves to enter trades when the trend is not so strong. If the instrument is within the daily ATR (Average Price Move), the Teeth line can be an excellent marker for entering trending trades. The tooth line is an 8-period SMA that travels five bars into the future.

- The blue line indicates the Jaw - this one is the strongest line. The Jaws line displays the border of the medium-term trend. When the price breaks this line, it usually means that the trend is reversing in the opposite direction. It is used to identify entry points to slow trends or in conservative trading strategies where traders prefer to trade only in the strongest zones. Jaw is a 13-period smoothed moving average that is shifted 8 bars into the future.

Note that the moving averages are calculated by the median price ((high+low)/2).

In the first stage, the Alligator is asleep and the three smoothed moving averages are at the same point. Taken together, the lines form the mouth of a hungry alligator.

- The lip line reacts first, as it is the fastest

- Then the line of teeth reacts

- The jaw line is the last to react

When the mouth opens, it signals that you should enter a trade.

Some key points about the Alligator Indicator

- Williams Alligator is composed of 3 lines, so it provides more and stronger Forex trading signals based on more data than many other one-line indicators.

- Williams approached the current behavior of the market instead of looking at past behavior to determine future outcomes. His indicators are designed to detect changes in the traders’ collective behavior that lead to the formation of new trends.

- To build trading signals, the Alligator Indicator uses convergence divergence ratios.

- The indicator is good at recognizing trends, their direction, timing to enter the trade, though it is almost useless during high volatility and trend absence.

- Usually, traders use one or two other indicators (MACD, TEMA, RSI, Stochastic, etc.) along with the Alligator Indicator to confirm the Buy or Sell signals.

- Before starting real trading on our terminals with the technical support of the Alligator Indicator and to recognize it more deeply and carefully, you can try demo-trading in a risk-free trading environment.

Alligator Indicator Strategy

When using the Alligator indicator strategy, traders must check if the Alligator is sleeping, it's when jaws, teeth and lips are intertwined and going horizontally. When Alligator lines and the Oscillator are starting to move in one direction the entry signal will appear, and traders will be able to confirm it by a breakaway of the nearest fractal on the chart.

When using Alligator Indicator strategy traders should look for buy and sell signals, let's us show how to find those

Alligator Indicator strategy buy signal - Buy signal appears when sleeping Alligator wakes up, in other words when indicator is gaining a growing trend (upward movement), but before entering the the market traders should make sure these conditions are met;

- The intertwined lines of the Alligator begin to go up and diverge - the alligator opens its mouth upwards, hunting for bears;

- The Awesome Oscillator histogram starts to grow from zero, its color is green.

So the entry point should be placed at the nearest fractal, lying above the Alligator lines. Place the stop-loss behind the level of the nearest opposite fractal, lying below the Alligator lines.

The main indicator for taking the profit is the red line of the Alligator. When the candlestick closes under the red line, traders should close their profitable position. Traders may take the profit before starting to lose on a correction, they should close the position as soon as a red bar on the Oscillator histogram appears.

- Alligator Indicator strategy sell signal - Selling signal appears when sleeping Alligator wakes up, in other words when indicator is starting downward trend, but before entering the the market traders should make sure these conditions are met;

- The intertwined lines of the Alligator begin to go down and diverge - the alligator opens its mouth downwards, hunting for bulls.

- The Awesome Oscillator histogram starts to descend from zero, its color is red.

- The price breaks away from the nearest local fractal lying below all three Alligator lines.

- If the impulse falling is sharp, traders should take the profit earlier, when the Awesome Oscillator shows a local reversal upwards, showing a green bar.

Bottom line on Alligator Indicator

The Alligator indicator is a good tool for detecting trend reversals early and assessing trend strength. It works on both long and short timeframes, but you shouldn't forget that no one indicator can provide 100% accurate signals.

Alligator is a momentum-based indicator, the main ability of this indicator is to determine market trend and its direction.

- Alligator is asleep when three lines are crossing over each other and the market is range-bound. When the green line crosses over the red line, it's a sign of a trend getting active in the near future (alligator waking up).

- Third stage is when three lines close above and below the price, meaning Alligator is awakened and hungry.

Note: Alligator indicator is better to use with other indicators, in order to get more accurate signals.

How to use Bill Williams Alligator in trading platform

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest