- Education

- Introduction to Trading

- What is Leverage

What is Leverage in Forex

What is Leverage

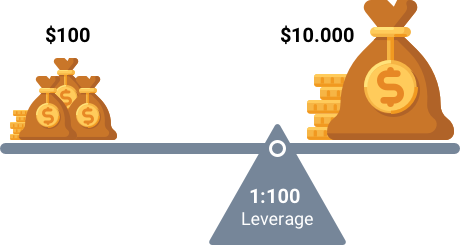

Leverage in Forex is the ratio of the trader's funds to the size of the broker's credit. In other words, leverage is a borrowed capital to increase the potential returns. The Forex leverage size usually exceeds the invested capital for several times. Leverage is the most commonly used tool in trading and it will help you better understand "What is Forex trading and how does it work" all about.

The size of leverage is not fixed at all companies, and it depends on trading conditions provided by a certain Forex broker.

So, Forex Leverage is a way for a trader to trade much bigger volumes than he would, using only his own limited amount of trading capital.

Sounds good? Nowadays, due to margin trading, each individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital (margin) that is required for maintaining trading positions.

But wait – there’s more to know about trading leverage ...

How to Choose the Best Leverage Level

Which is the best leverage level? - The answer to the question is that it is hard to determine which is the right leverage level.

As it mainly depends on the trader's trading strategy and the actual vision of upcoming market moves. That is, scalpers and breakout traders try to use high leverage, as they usually look for quick trades, but as to positional traders, they often trade with low leverage amount.

So, what leverage to use for forex trading? - just keep in mind that Forex traders should choose the level of leverage that makes them most comfortable.

IFC Markets offers leverage from 1:1 to 1:400. Usually in Forex Market 1:100 leverage level is the most optimal leverage for trading. For example, if $1000 is invested and the leverage is equal to 1:100, the total amount available for trading will equal to $100.000. More precisely saying, due to leverage traders are able to trade higher volumes. Investors having small capitals prefer trading on margin (or with leverage), since their deposit is not enough for opening sufficient trading positions.

As it was mentioned above, the most popular Leverage in Forex is 1:100.

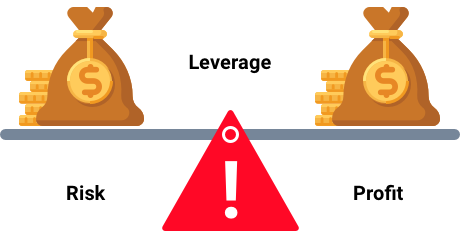

So what’s the problem with high leverage? - Well, the high leverage, besides being attractive is very risky too. Leverage in Forex may cause really big issues to those traders that are newcomers to online trading and just want to use big leverages, expecting to make large profits, while neglecting the fact that the experienced losses are going to be huge as well.

How to Manage Leverage Risk

So, while leverage can increase the potential profits, it also has the capability to increase potential losses as well, that is why you should choose carefully the amount of leverage on your trading account. But it should be noted that though trading this way require careful risk management, many traders always trade with leverage to increase their potential returns on investment.

It is quite possible to avoid negative effects of Forex leverage on trading results. First of all, it is not rational to trade the whole balance, i.e. to open a position with the maximum trading volume.

That's not all ...

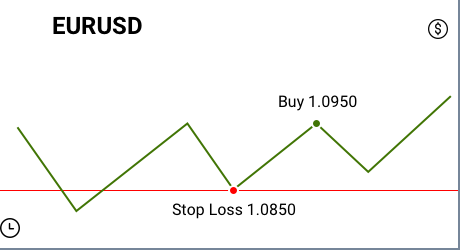

Apart from that, Forex brokers usually provide such key risk management tools as stop-loss orders that can help traders to manage risks more effectively.

Here are the basic points to manage the leverage risks properly:

- using trailing stops,

- keeping positions small

- and limiting the amount of capital for each position.

So, Forex leverage can be used successfully and profitably with proper management.

Keep in mind that the leverage is totally flexible and customizable to each trader's needs and choices.

Now having a better understanding of Forex leverage, find out how trading leverage works with an example.

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest

Forex Leverage Example

How does Leverage Work Account balance is $1000 with 1:100 leverage. You have decided to open a buy position with EURUSD pair with a volume of 10.000. The position is opened at price 1.0950. Stop Loss order is set at 1.0850 price. The required margin for this position is equal to €10 000 x 1/100 x 1.095 = $109.50. If you do not want to spend much time on calculating margin for all of your positions you may use our Margin Calculator. In case the market goes in different direction, your loss will equal to $100, since 1 pip value in EURUSD currency pair is $1 (for 10.000 volume), and the difference between your opened price and Stop Loss level is 100 pips. If you do not use Stop Loss order, you may lose pretty higher than $100, depending when you will close your position. Stop Loss order can be used both for Long and Short positions and its level is decided by you; that is why it is one of the best risk management tools in online trading.

Other than Forex, leverage can be used in cryptocurrency, stocks, index markets. A common way traders use leverage in crypto market is to increase their capital's liquidity. Using leverage to keep the same position with lower collateral, allows traders to put their assets to a better use, for instance trading other decentralized assets. To understand how leverage works in the cryptocurrency market, you first need to know What is Leverage in Crypto Trading.

How to Calculate Leverage in Forex

To measure the leverage for trading - just use the below-mentioned leverage formula.

Leverage = 1/Margin = 100/Margin Percentage

Example: If the margin is 0.02, then the margin percentage is 2%, and the leverage = 1/0.02 = 100/2 = 50.

To calculate the amount of margin used, just use our Margin Calculator.

Read more about What is Leverage.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.

Was this article helpful?

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center

You can study CFD trading more thoroughly and see CFD trading examples in the section How To Trade CFDs Visit Educational Center Register with IFC Markets Now

Global Access to Financial Markets from a Single Account