- Education

- Forex Technical Analysis

- Technical Indicators

- Oscillators

- Williams Percent Range

Williams Percent Range - What is %R

How to Use %R

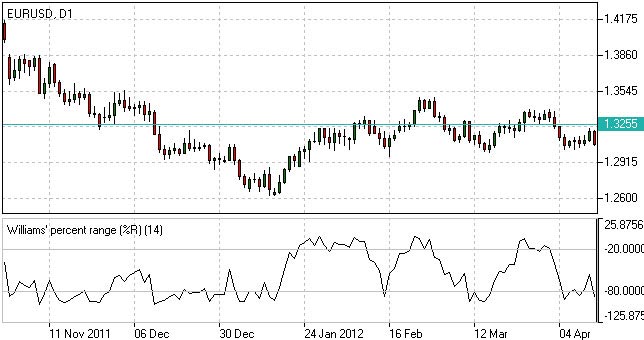

The main goal of Williams Percent Range is to identify possible overbought and oversold areas, however the indicator should be considered within trend analysis:

- Generally if the indicator climbs above -20, the asset may be overbought;

- If the indicator drops below -80, the asset may be oversold.

Leaving extreme areas the indicator may suggest possible turning points:

- Crossing the overbought boundary from above, Williams Percent Range signals a possible sell opportunity;

- Crossing the oversold boundary from below, Williams Percent Range signals a possible buy opportunity.

Divergence patterns are rare, but may indicate possible trend weakness:

- If the price climbs to a new high, but the indicator does not, that may be a sign of the uptrend weakness;

- If the price falls to a new low, but the indicator does not, that may be a sign of the downtrend weakness.

Williams Percent Range Indicator

Williams Percent Range strategy

Williams %r indicator, as already mentioned, helps to determine the points when the market is oversold or overbought. The trading rules of Percent Range strategy are simple:

- Buying when the market is oversold (%R reaches -80% or lower);

- Selling when the market is overbought (%R reaches -20% or higher).

Williams %R Formula (Calculation)

To calculate the WPR indicator, the difference of the high price and the closing price over a period is divided into the difference of the high and low prices over a period. The default period is equal to 14 (the last 14 bars from the considered price chart).

R% = - ((H - C)/(H – L)) x 100; where: C – latest close price; L – the lowest price over a given period; H – the highest price over a given period.

How to use Williams Percent Range in trading platform

Forex Indicators FAQ

What is a Forex Indicator?

Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting.

What are the Best Technical Indicators?

Technical analysis, which is often included in various trading strategies, cannot be considered separately from technical indicators. Some indicators are rarely used, while others are almost irreplaceable for many traders. We highlighted 5 the most popular technical analysis indicators: Moving average (MA), Exponential moving average (EMA), Stochastic oscillator, Bollinger bands, Moving average convergence divergence (MACD).

How to Use Technical Indicators?

Trading strategies usually require multiple technical analysis indicators to increase forecast accuracy. Lagging technical indicators show past trends, while leading indicators predict upcoming moves. When selecting trading indicators, also consider different types of charting tools, such as volume, momentum, volatility and trend indicators.

Do Indicators Work in Forex?

There are 2 types of indicators: lagging and leading. Lagging indicators base on past movements and market reversals, and are more effective when markets are trending strongly. Leading indicators try to predict the price moves and reversals in the future, they are used commonly in range trading, and since they produce many false signals, they are not suitable for trend trading.

Use indicators after downloading one of the trading platforms, offered by IFC Markets.

Not sure about your Forex skills level?

Take a Test and We Will Help You With The Rest